'Renewables plus hydrogen' - almost all that we need

The world’s entire energy system is going to be built around renewable electricity and green hydrogen. This was an unconventional assertion to make as little as six months ago. In some parts of the world it is now perceived to be a statement of the obvious.

The purpose of this note is to provide basic details of the major large-scale experiments and commercial projects in Europe and elsewhere that demonstrate that hydrogen can fully complement green electricity and will provide the energy source for almost all activities that cannot be electrified. I write because I think that the development of a ‘renewables plus hydrogen’ economy should be the policy priority for the UK and other countries.

Renewable electricity

Electricity will become the power source for almost all surface transport, including buses and many heavy vehicles. Electricity will provide increasing percentages of the low temperature heat that we need, principally through the use of heat pumps in homes and offices.

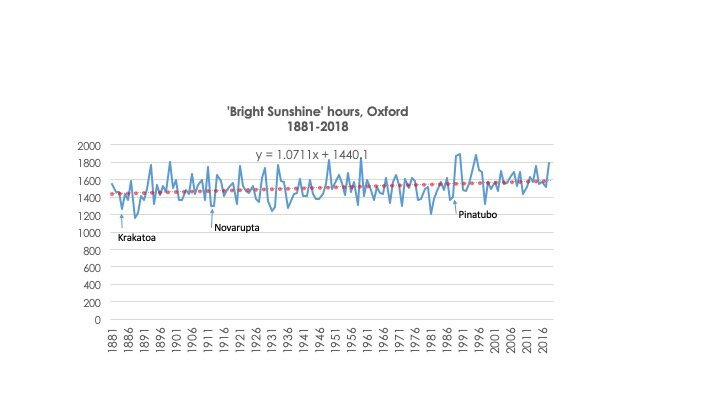

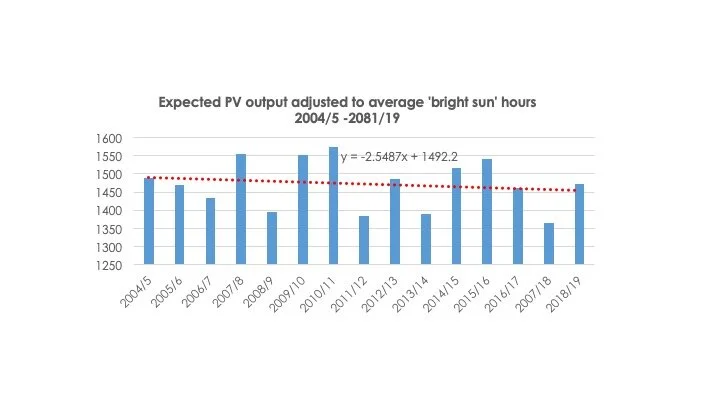

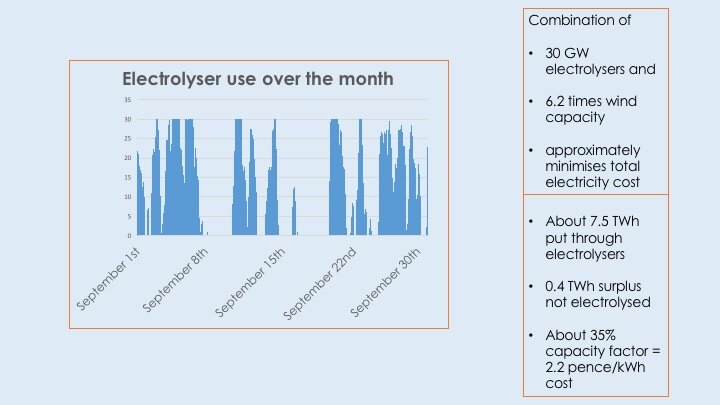

I propose in What We Need To Do Now that we deal with the problem of intermittency of most renewable source of electricity by massively expanding our capacity to collect energy from the wind and the sun. This will give us sufficient electricity almost all of the time, reducing to almost zero our need for backup sources of power.

Most of the time our electricity system will have major surpluses. These surpluses will be converted into hydrogen, perhaps accompanied by batteries for storing daily surpluses of solar electricity. This large volume of hydrogen (perhaps as much as 1,000 terawatt hours in energy value for the UK, or 3 times our current power consumption) should be productively employed to provides the energy for almost all other activities in the economy. The best use is to employ it to make hydrogen, via the simple process of electrolysis of water.

A list of the other many potential uses of hydrogen follows, alongside the brief statement of recent large scale trials that have been announced.

Hydrogen uses

1, Hydrogen as a source of energy for generating electricity

On the rare occasions when renewable electricity plants are not providing enough electricity, hydrogen can be used as a zero carbon fuel to generate electricity. This can either be done through the use of fuel cells or by employing turbines modified to burn hydrogen.

The hydrogen will have been initially made by water electrolysis and probably stored in underground salt caverns or disused oil or gas fields. The process of making hydrogen from electricity and then converting it back to electricity when needed is called ‘PowerToGasToPower’ (P2G2P).

Key experiments: In southwest France, paper company Smurfit Kappa operates a paper mill. The 12 megawatt power and heat needs for this mill are provided by a Siemens turbine that currently runs on natural gas. A project announced in May 2020 will see the existing turbine repurposed to run on hydrogen. When electricity is in good supply, an electrolyser will produce the hydrogen, which will be stored on site. The hydrogen will be used when power is scarce, or the price high. By 2023, this €15m scheme should be able to demonstrate flexible operation that allows the turbine to be run on up to 100% hydrogen.

On Orkney, a chain of islands off north eastern Scotland, hydrogen produced at a wind farm is transported by sea to the main port where it is used in a fuel cell to create power to operate dockside equipment. This trial was one of the first P2G2P experiments in the world.

2, Hydrogen provides the fuel for building heating systems

Scottish Gas Networks, which manages gas distribution across Scotland and parts of England, announced a plan to shift 300 homes in the Levenmouth area in eastern Scotland from natural gas to hydrogen, starting in 2021. The hydrogen will be made using electricity from an offshore wind turbine. . Individual homes can be converted using a replacement of the central heating boiler with a hydrogen equivalent. Worcester Bosch, the UK’s largest supplier of domestic boilers has produced hydrogen equivalents that are similar in cost to standard devices.

In the Netherlands, a house refurbishment was completed last year that includes a hydrogen central heating boiler, powered by an electrolyser that gets its electricity from solar panels on the roof. The hydrogen is stored in a small container in the garden of the house.

A small number of other places around Europe are operating gas networks with 20% hydrogen added. One example is the network around Keele University in the UK. SNAM, the main Italian gas company, is similarly running experiments that gradually increase the percentage of hydrogen in natural gas piped to two factories near Naples.

3, Running road vehicles

Electricity stored in the car’s batteries will probably be the power source for almost all domestic and light commercial vehicle use. But some car companies still believe it will be possible to use fuel cells instead, even though they are currently much more expensive to build.

Hydrogen is stored in the car and is fed into the fuel cell. Electricity is generated which then powers the car’s electric motors. This can provide much longer range than most pure electric cars. Germany, for example, now has about 100 hydrogen refuelling points. This enables a hydrogen car to be driven with security around the entire country.

The highly-rated US commercial vehicle startup Nikola will launch a pickup truck that can either be powered by batteries or by a hydrogen fuel cell. The fuel cell version will have a claimed range of 600 miles. Launch will be in 2022, but the company’s larger full sized truck will be available in late 2021 fuelled by hydrogen.

Because they can be powered by hydrogen or batteries, road vehicles are entirely compatible with a ‘renewables+hydrogen’ future.

4, Trains and ships

The French manufacturer Alstom has launched a train that runs on hydrogen. It has operated successfully on a line in northern Germany and will also be trialled in Italy and the UK.

Ships that travel regularly between islands or across fjords can be easily switched to electric power. Over 100 battery powered ships are at work around the world. Longer distance shipping cannot be fully electrified because of limitations on battery capacity. The industry is actively debating whether the future is based around ammonia (which is made from hydrogen) or hydrogen itself.

A new Norwegian cruise ship will be powered by hydrogen (and batteries) when it is launched in 2023. . Norway is the leader in moving to hydrogen for ships alongside France. Hydrogène de France is working with Swiss engineer ABB to build large-scale hydrogen fuel cells for international shipping.

A recent study concluded that almost all cross-Pacific shipping could be switched to hydrogen without difficulty.

5, Aviation fuel

Although very short distance flights may be possible in battery-powered planes, the large bulk of greenhouse gas emissions arise from longer journeys. 80% of emissions come from journeys over 1,500 km, The alternatives are hydrogen fuel cells for smaller planes and low-carbon replacements for conventional fuels for larger aircraft. These two routes will be vital if we are to avoid greenhouse gas emissions from aviation making the achievement of ‘net zero’ impossible

ZeroAvia makes an airplane for 10-20 passengers that uses hydrogen in a fuel cell as the power source. It plans to start a service between Edinburgh and Orkney, off the north-east coast of Scotland.

Larger airplanes will use synthetic kerosene, almost certainly made from hydrogen and carbon dioxide. Although some waste materials can be gasified and turned into fuel, the large volumes of aviation kerosene required around the world probably mean that most will be made from hydrogen coming from water electrolysis.

Two projects have been recently announced that seek to make ‘drop-in’ replacements for today’s fuel. In Norway, Climeworks and Sunfire have joined local partners to build a plant that makes aviation kerosene from air-captured carbon dioxide and hydrogen made from renewable electricity. By the end of 2023, Norsk eFuel targets output of enough synthetic fuel to cover 50% of the needs of the busiest 5 Norwegian internal flights. The venture then aims to make 100 million litres of fuel a year by 2026 in a ten times expansion of its pilot plant.

A similar new enterprise in Denmark seeks to replace 30% of the aviation fuels used at Copenhagen airport by 2030. The business is operated by a consortium that includes Maersk, the world’s largest shipping company, and Orsted, the offshore wind operator.

6, Steel

At present, new steel is made in blast furnaces in which coal is used to heat iron ore. The carbon from the burning coal merges with the oxygen in the ore, leaving liquid metal, which flows out of the furnace. This process, and the associated manufacturing activities, may be reasonable for as much 7% of global emissions.

Steel can be made using hydrogen instead of coal. Burning hydrogen can capture the oxygen in iron ore in an analogous way to coal. The furnaces are different but the outcomes are similar. A good description of how the hydrogen production compares to coal is given here.

Several steelmakers have announced plans for switching to hydrogen. Among the most advanced is the large speciality steelmaker SSAB which makes steel in Sweden and Finland. SSAB is building a trial furnace running entirely on hydrogen made with renewable energy. The company says that it will have commercial carbon-free steel available by 2026 and all its steel production will be completely zero-carbon by 2045.

In June 2020, German steelmaker Thyssen Krupp announced a move towards hydrogen. It will buy renewable hydrogen from the utility RWE for use in a blast furnace at its plant in Duisburg. A 100 MW electrolyser will make sufficient hydrogen to produce about 50,000 tonnes of carbon-free steel. Thyssen Krupp makes about 8 million tonnes of steel a year or 160 times as much but this is a first step towards entirely carbon-free steel production by 2050.

7, Fertiliser production

The Norwegian fertiliser giant Yara is heavily involved in trials of making the hydrogen for fertiliser production from renewable electricity. It will supply part of the part of the hydrogen need for its Porsgrunn plant in Norway from a 5 MW electrolyser.

It is investigating a much larger trial at its plant in Pilbara, Western Australia. Here it hopes to integrate green hydrogen made by a subsidiary of the French energy giant Engie into its existing production process.

8, Oil refineries

Oil refineries use almost half the total amount of hydrogen produced today. Almost all is generated from fossil fuels, principally natural gas. Several refineries are investigating switching to hydrogen from renewable electricity. On the east coast of England, for example, Danish offshore wind company Orsted is planning to bring power onshore from the Hornsea 2 farm and put into an electrolyser. The hydrogen will be then piped to the Immingham oil refinery.

In the Netherlands, a similar scheme will feed Europe’s large oil refinery at Pernis near Rotterdam owned by Shell. Offshore wind power will be used to make hydrogen which will be used in the refinery’s operations

Any output of a conventional oil refinery is, of course, not zero carbon. But making hydrogen from renewables will reduce the net climate impact of using fossil fuels. In the long term, the world will still need refineries to make materials such as plastics from synthetic fuels made from hydrogen and sources of carbon.

Conclusion

What CO2 generating activities cannot be switched either to electricity or to hydrogen? The list is very short. The most important industry is probably cement making. Heat is needed to drive off the carbon dioxide from calcium carbonate and this can be provided by hydrogen rather than coal. But the chemical reaction in the process must inevitably produce CO2. This CO2 is gradually recaptured by concrete or other uses of cement but this reaction is quite slow. (Innovative technologies, such as that used by CarbonCure can incorporate CO2 into drying concrete at a much faster rate).

Otherwise electricity or hydrogen can cover almost all our energy needs. Other greenhouse gases will be produced from activities outside the energy system, of which agriculture is the most important culprit. However the central fact is that nearly complete decarbonisation of the energy system is possible using renewable electricity and hydrogen. As renewables become cheaper and cheaper around the world, also pulling down the price of making hydrogen, this decarbonisation will involve only small and temporary cost increases for energy. In the medium term, ‘renewables plus hydrogen’ will be cheaper than any other sources.

June 17 2020