Section 3: Maximum requirements at the most local level

· Domestic heating and car charging largely occur at the very edge of the network in people’s homes. The average home today typically uses about 0.4 kW over the course of the day and year, although this will obviously vary enormously from hour to hour, depending on whether the dryer, cooker, toaster or other power-hungry appliances are in use. Home car charging can be up to 7 kW and a big heat pump can use over 4 kW. In other words, the new applications can multiply peak usage in the home several times.

· Heat pumps and electric vehicles are likely to grow fastest in more prosperous areas. I guess that at the edge of the network maximum electricity needs are likely to rise many fold from today’s numbers in some areas. This means that upgrades will be required in the local distribution systems and at the neighbourhood substations often covering about a hundred homes.

Section 1: Total annual power needs

Domestic heating, including hot water and cooking.

Gas demand across the UK for domestic purposes was about 299.3 TWh in 2020. This figure was probably slightly inflated by the numbers of people staying at home to work. The 2020 figure was about 1.5% up on the previous year. In addition, the amount of oil used for domestic heating was equivalent to about 26.7 TWh in the 4% or so of UK homes using this fuel. Coal used for home heating adds another 4.1 TWh or so.[3] Total input of fuels was therefore about 330.1 TWh

I assume the following approximate percentages for the efficiency with which the fuel is turned into heat

Gas boiler - 85%

Oil boiler - 75%

Coal - 40%

These figures give us an estimate of 276.1 TWh for the heat currently used by UK homes. We do know, by the way, that the UK’s poor insulation standards across its home network mean that many people do not heat their home sufficiently for their health and comfort.

If we move to 100% heat pumps, we won’t need as much energy as this. Heat pumps provide more heat that the electricity input required. Estimates vary but approximately 2.7 units of heat are delivered by the typical UK heat pump for every unit of electric power used.[4] This measure is called the Coefficient of Performance (COP).

Dividing the 276.1 TWh total heat need by 2.7 means that the UK would need an extra 102 TWh or so of electricity to meet all domestic requirements for powering heat pumps in homes currently using gas, oil or coal. 2020 total electricity use was about 279.2 TWh, a figure pushed down by the pandemic.[5]

Of this, domestic electricity consumption in 2020 was about 107.8 TWh but this includes some electricity used today for heating in storage radiators or other electric appliances. About 8.5% of the UK’s 27.8m households use electricity for heating, principally in the form of storage radiators, usually charged with heat overnight. I estimate that these use 7,000 kWh of electricity per year on average, implying a total demand for electricity for heating of about 16.5 TWh.

If these homes are switched to heat pumps, they would need less electricity. At a COP of 2.7, the aggregate saving for the UK is 10.4 TWh.

So the impact of switching all homes to heat pumps is as follows[6]

UK electricity need before a 100% switch to heat pumps = 279.2 TWh

100% heat pumps for gas, oil and coal heated homes = 102.2 TWh

Reduction in electricity need from converting currently electrically heated homes to heat pumps = minus 10.4 TWh

Total demand after conversion to heat pumps of all UK homes = 371.0 TWh

(Percentage increase as a result of switch to heat pumps =32.9%)

(NB, a small fraction of electricity is lost during transmission and distribution. More power needs to be generated than is consumed. This loss currently amounts to about 7%.)

Car charging

The typical car in the UK drives about 7,500 miles/12,000 km a year. On typical journeys – not just fast motorway drives or very slow urban trips – an EV probably consumes about 1 kilowatt hour of electricity per 6 kilometres. So each car needs approximately 2,000 kilowatt hours a year. There are approximately 32 million passenger cars in the Great Britain, and probably about 33 million including Northern Ireland, although I cannot find the data to confirm this number. Assuming a total of 33 million, the total electricity consumption of the passenger fleet would be 66 terawatt hours.[7]

What about the impact of electrifying all transport, including buses, light vans and larger lorries? The easiest way to provide an approximate estimate is to look at the consumption of fuels (diesel and petrol) for all types of vehicles. The RAC Foundation says this figure was about 46.9 billion litres in 2019. I have ignored the artificially low number for 2020.[8] The RAC number combines diesel fuel and petrol. Diesel has an energy value per litre about 10% greater than petrol and the average is probably about 10.4 kilowatt hours per litre.

These numbers suggest a total energy consumption of all the vehicles on UK roads of around 487.8 TWh.

Petrol and diesel are less efficient at moving vehicles than electricity. Whereas the motor in an electric car will deliver perhaps 90% efficiency, the average internal combustion engine probably offers no better than 25% conversion of energy to motion.

When the UK has replaced all internal combustion engine vehicles with batteries (and therefore assuming that fuel cell cars and lorries never gain a significant share of sales) the amount of energy required will therefore fall a long way from today’s levels. I estimate the number will be about 135.5 TWh, roughly double the electricity need for private cars alone.

Current electricity consumption is about 279.2 TWh. Full electrification of all vehicles would add about 48.5% to this figure

Current electricity consumption = 279.2 TWh

1) Electricity needed for private cars alone = 66.0 TWh

(Percentage increase as a result of switch to electric cars = 23.7%)

2) Electricity needed for full conversion to battery vehicles = 135.5 TWh

(Percentage increase as a result of the switch of all vehicles = 48.5%)

Summary Section 1: electrification of domestic heating and all vehicles.

The total extra amount of electricity needed to handle the requirements for all domestic heating (not commercial buildings, offices or industry) and all road vehicles will be approximately as follows:

Current electricity demand = 279.2 TWh

Extra demand created by shifting 100% to domestic heat pumps = 91.8 TWh

Extra demand created by shifting all transport to electricity = 135.5 TWh

Total increase = 227.3 TWh

(Percentage increase as a result of the two switches = 81.4%)

Is this a manageable increase? Very approximately, it will equate to the power output of 50 GW of offshore wind. This is roughly the amount that is likely to be in place in UK waters by the early part of the next decade. In other words, it is a large increment to electricity demand but is clearly within our reach.

That’s the first question answered, albeit with considerable uncertainty. Over the course of a year we can switch the most polluting activities to electricity, as long as we invest enough in renewable energy. But of course industrial and commercial heating will add additional electricity needs when they switch to low carbon heat.

What about the second question? Can electricity match the needs on an hour by hour basis, as well as year to year? This is much more difficult question to respond to.

Section 2: Peak electricity requirements

Domestic heating including hot water and cooking

A 2019 paper in the journal Energy Policy gave us very useful data on the hourly patterns of gas use in domestic homes.[9] It looked carefully at dates of very high heating need, focusing on a very cold period in December 2010.

The research showed that typical heat requirements in natural gas heated UK homes on these days peaked at around 170 GW at about 17.00 in the early evening. This is approximately the time of the maximum UK electricity demand as well.

Since 2010, electricity demand from homes has fallen sharply. Gas demand has declined much less, and there has actually been a rise in recent years as the efforts to improve insulation have stalled. I have assumed that a really cold day still requires about 170 GW of peak gas availability.

Peak electricity demand so far in winter 2021/22 has been about 48 GW. This occurred at around 17.00 on 10 January 2022. Average temperatures were higher than the figures recorded in 2010, so the comparison between 48 GW of electricity demand and 170 GW of gas use is not entirely fair. A better estimate might be that the need for electricity on a really cold day is now approximately 50 GW, before taking demand management into account. But under any assumptions, peak heating demand with gas is still several times that of electricity use.

The next phase in the calculation is to add in the use of oil and coal for heating to supplement the gas needs. If we assume that these alternative fuels provide the same percentage of heat requirements as they did in the analysis in section 1 above, the total demand for all domestic heating fuels would be about 187 GW on the coldest day in 2010. Boilers aren’t 100% efficient, as discussed above, and this figure delivered about 156.4 GW of heating into the home.

If we transfer all heat demand to heat pumps, we will not need as much input energy. In the section above, I use a COP estimate of 2.7 across the whole year. On a very cold day, this figure will be much lower. I suggest a number of 2.0 is more appropriate, implying that total electricity demand for home heating will be about 78.2 GW. (If we include all non-metered domestic buildings, that number would be well over 100 GW).

The conclusion is therefore as follows

Peak UK electricity demand on a very cold day in 2022 = About 50 GW

Extra electricity demand from a 100% conversion to heat pumps = About 78.2 GW

(without demand management)

Total electricity demand peak with 100% domestic heat pumps = About 128.2 GW

(Percentage increase as a result of the switch = About 156%)

This is a very different set of numbers to the ones in Section 1 above. It can be argued that they are too pessimistic; heat pumps can be temporarily turned off at times of highest electricity demand and their output could be replaced by thermal stores of heated water for many hours a day. But these stores will add substantially to the installation cost of new heat pumps. And in cold winter period, electricity demand never falls to very low levels. So moving heating requirements to periods of the day in which demand is lower – principally between 23.00 and 07.00 does not shave much from peak demand.

On 12th January 2022, minimum demand was about 28 GW, compared to a maximum demand of 48 GW. If all the needs for electricity for heating were shifted to the lowest use periods, maximum demand would therefore fall from about 128.2 GW to about 108.2 GW, or over twice 2022’s highest level. But this switch is implausible; the reality is that heating demand serviced by heat pumps cannot be entirely switched to the overnight hours. There won’t be enough thermal storage to make this possible.

These numbers are indicative but they strongly suggest that a UK with 100% heat pumps will need to accommodate peak electricity demands of well over twice today’s levels. Perhaps a figure of around 115-120 GW is plausible compared to the current 50 GW on the coldest days.

In the high summer, of course, heating demands will fall to near zero. The seasonal variability of electricity need will therefore be significantly magnified. The low peak demand levels of around 35 GW in high summer will stay the same, but midwinter peaks will rise to perhaps 120 GW or almost four times as much.

Charging of all road vehicles

In section 1 I asserted that demand increases from moving to 100% electric cars and other vehicles would add about 135.5 TWh to annual UK electricity needs. Spread equally over all 8,760 hours of the year suggests a continuous need of about 15.5 GW to add to peak needs of around 50 GW on today’s coldest days. This is an addition of about 31%.

We can improve this by prompting drivers to move to charging at periods of low overall demand, particularly by using varying prices according to the time of day. But the extent to which this will affect charging patterns is as yet unclear.

A 50 kWh battery charging at a 7 kW home charger will move from 20% charged to 100% in about eight hours, and possibly more. (Charging rates drop as the battery comes close to being full). So if the regulations and incentives (such as lower prices) can be put in place, most domestic car charging could be carried out between 23.00 and 07.00.

But if personal car charging is being carried out at slower rates for example at the workplace, it will not be possible to only charge at the periods when overall electricity needs are at their lowest. And for those car owners taking long journeys during the day, and needing to charge away from home or work, only using electricity at the periods of lowest demand will be impossible.

On the other hand many commercial vehicles will be able to charge overnight. Buses, for example, can be filled up at the end of the working day. But some other vehicles, such as overnight delivery vehicles for supermarkets, will be operating at times of low overall electricity demand and therefore will not be available for battery charging.

I guess that the UK can probably hold peak vehicle charging demand in a 100% electrified system to around 5 GW by carefully incentivising drivers to fill batteries at times of low overall electricity demand.

Summary Section 2: electrification of domestic heating and all vehicles.

Peak electricity demand on a very cold winter day is about 50 GW and occurs at around 17.00 on working days.

The 100% use of heat pumps is likely to raise that figure to about 115 – 120 GW. And vehicle charging might be expected to add another 5 GW.

Total electricity needs are therefore going to peak at close to 125 GW, or two and a half times current levels. This is a very substantial challenge for electricity supply.

Section 3: Maximum requirements at the most local level

It is inevitable that at the edge of the electricity distribution network, the impacts of electrification of heating and of transport will have even more dramatic effects. Merely by statistical chance, the pattern of hourly demand at local substations serving perhaps a hundred homes will be more varied than across the country as a whole.

So, whereas electrification of heat and transport may raise electricity demand overall to about 250% of the current level, at individual substations or transformers the effect will be even more striking. In a small area all homeowners could decide to charge all their cars at once and turn up the thermostats to heat their houses to higher temperatures.

The consequence of this possibility is that the local distribution companies will be obliged to increase the capacity of all substations by a percentage far greater than is going to be required for the central skeleton of the transmission system (‘the National Grid’). Whereas at the core of the network capacities will need to be raised to two and a half times present levels, individual end-of-branch transformers will have to be improved so that the scope for carrying power will be multiplied by perhaps five or ten times. Only experience will tell us what these new capacity levels will have to be.

Multiplying power flows by five or ten times at the very edge of the network will be costly and difficult. I have been unable to find estimates for the money that will have to be spent at individual transformers. However there are about 400,000 edge of network transformers in the UK and if the cost is £10,000 at each location the bill will be about £4bn or around £140 per home.[10]

Conclusions

I believe that handling peak demand for home heating using electricity will be a very difficult challenge to address. We are likely to see a two and a half times multiple of existing peak electricity demand. As a consequence, the UK and other countries with poorly insulated houses may need to use hydrogen for some fraction of domestic heat.

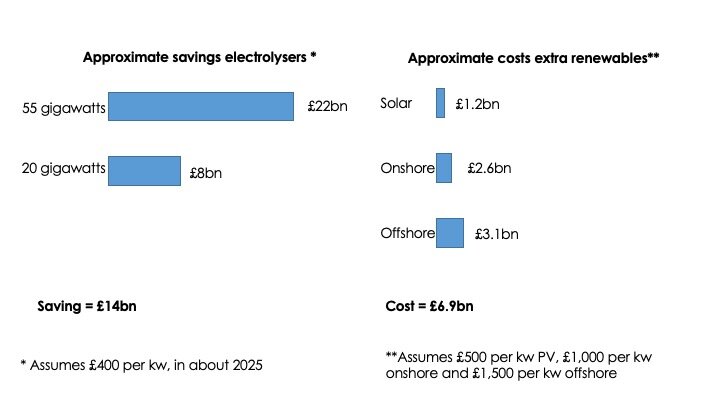

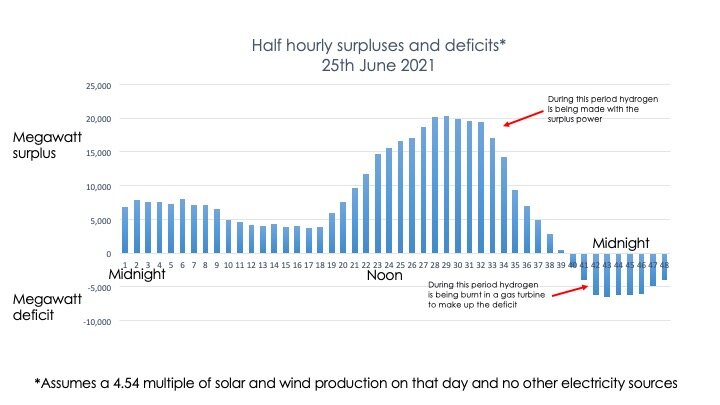

An alternative, which I talked about in a recent post, is to use hydrogen as the key storage medium for a world in which peak electricity demand has risen several fold from today’s levels. The seasonal variability of peak needs will rise sharply as a result of heat electrification and I strongly suspect it makes real sense to store surplus power in the form of hydrogen to address these steep swings in demand. This can either mean the use of hydrogen power stations for reconversion to electricity or the distribution of hydrogen via the existing gas grid to fuel cells close to the point of consumption. This idea has not been explored sufficiently yet.

[1] For the purpose of making these calculations I assume that these future EVs are pure battery vehicles, rather than plug-in hybrids. The market share of hybrids in the UK and elsewhere is tending to fall and most industry commentators suggest that the pure EVs will dominate within five years.

[2] I use numbers in this analysis rounded to the first decimal point. I am not intending to imply this degree of precision but wanted to ensure that the additions are clear.

[3] These numbers are derived from the DUKES report of the UK government. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1023276/DUKES_2021_Chapters_1_to_7.pdf

[4] This study, for example, gives an estimate of 2.65 for Air Source Heat Pumps and 2.81 for Ground Source: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/606818/DECC_RHPP_161214_Final_Report_v1-13.pdf

[5] Electricity production was about 312 TWh, a number that includes losses in transmission and electricity consumed by the energy industry itself.

[6] I have ignored the very small number of UK homes with existing heat pumps.

[7] I have not included the existing battery car fleet of about 1.5% of the total in these calculations, nor the 3% of plug-in hybrids (which often principally use petrol or diesel because of the small size of their batteries).

[8] https://www.racfoundation.org/data/volume-petrol-diesel-consumed-uk-over-time-by-year

[9] https://www.sciencedirect.com/science/article/pii/S0301421518307249#bib34

[10] https://www.emfs.info/sources/substations/final/