Integration of European electricity markets will leave Germany controlling EU energy policy as much as it dominates financial policy today.

As renewable energy production grows across Europe, the need for better interconnection between national electricity grids increases. One country’s temporary surplus of wind power can be exported to a network that needs more sources of electricity. As interconnection improves, electricity prices will tend to equalise across the continent but at the price of the dominant producer, Germany. The implications of this are not fully understood: the market for electricity in a networked Europe will be increasingly dominated by the state of German electricity supply. When Germany has too much power, prices will be driven down elsewhere. In fact, they already are. If Germany is in deficit, markets will spike. The impact of better interconnection will be similar to the effect of the Euro, leaving Germany in de facto control of energy markets as much as it is today in control of economic policies across the Euro zone.

I don’t mean this article to be an apocalyptic or nationalistic argument for an isolated Britain. But I do want to suggest that UK energy policy appears to ignore the impact of what is going on in Europe’s biggest economy, one in which the commitment to a full transition to low carbon electricity remains strong, even as concerns mount about the rising consumer price of power.

Germany today has about 31 gigawatts of wind power and 35 gigawatts of solar PV as well as 3 GW of hydro. For comparison, peak German electricity need is about 65 gigawatts and minimum use falls to around 30 gw. Its wind power is almost a third of total European capacity and it is probably as dominant in the provision of solar electricity. The country’s electricity grid is well connected to surrounding states. However on many occasions over the past six months German oversupply of renewable power (which is given priority access to the national grid systems) has overwhelmed the capacity of Germany and its neighbours to absorb the power. At some times Germany has been exporting nearly 20 GW to neighbouring countries. The impact, as we might expect, has been to force down the price of power, sometimes to below zero. (Users are paid to take extra electricity).

Britain expects to move from about 8 gigawatts of installed wind power today to around 50 gigawatts by 2030. Solar PV, over 3 gigawatts by the end of 2013, will increase sharply as well and is more difficult for government to choke off because installations on, say, factory roofs may make financial sense without subsidy. PV is therefore moving beyond the reach of government energy policy. 10 or 20 gigawatts of power (much not directly measured by the grid because it subtracts from building power need) by 2030 is perfectly possible.

This growth in British renewable power will have the same effect as wind and solar have had in Germany. We’ll need to export in order to use all the electricity generated. UK electricity demand reaches a minimum of around 25 gigawatts at weekends in summer (and this minimum is tending to fall). At times like this, the 50 gigawatts of wind will, by itself, sometimes exceed domestic power need. Today, Sunday 15th September, wind power will produce almost 20% of UK electricity at midday. By 2030, winds of this speed would force us to export vast amounts of power.

So the assumption goes, we need better interconnectors with Europe to provide an outlet for our over-supplied grid. Yes, of course, interconnectors will help. But we need to remember two things. First, when it is windy or sunny here, the Germans and much of the rest of the Europe will be seeing similar meteorological conditions. Second, interconnectors flow both ways: if the Germans have too much electricity, their exports will reduce prices in any country on the same international grid. Low German wholesale prices will leak into the British market within minutes.

The impact of the first point is obvious. When we have too much wind, the Germans will usually be similarly affected. We will not be able to export, even at negative prices, because the whole of Europe will probably be oversupplied.

To study this assertion, I looked at electricity production from wind power across Europe during the ten day period from 20th to 29th March this year. This period seemed appropriate because it included a sustained period of high winds in the UK from the 21st to the 23rd. I obtained data from the electricity markets of the UK, Germany, Spain, France, Denmark and Ireland for these days. Together, these countries represent about three quarters of European wind capacity and include all five of the biggest producers.

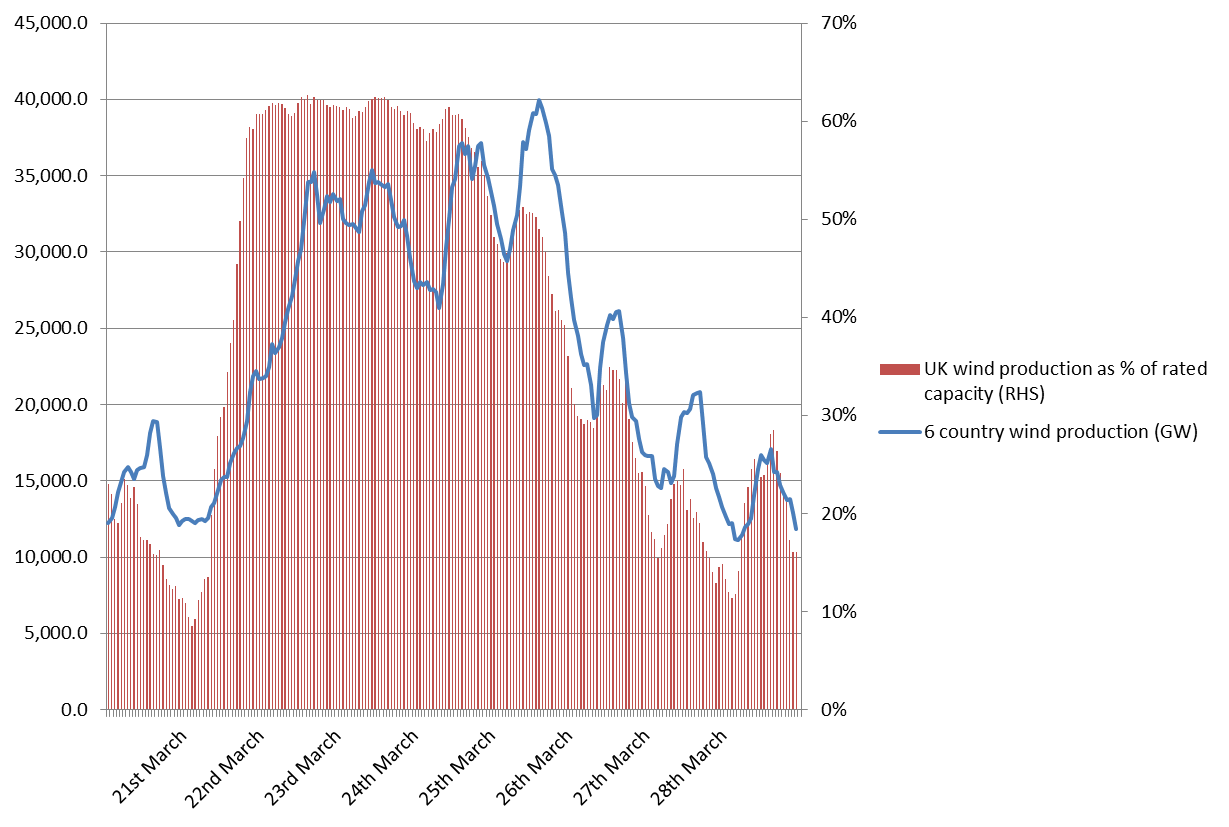

I plotted the total amount of power generated each hour in the six countries and compared it to the capacity utilisation of UK turbines. [i] For most of the 22nd and 23rd, the UK saw wind production of over 5 gigawatts, or up to about 17% of power need. Chart 1 shows that UK wind production rose sharply during the 21st of March, somewhat earlier than wind power increased across Europe. (As might be expected from an Atlantic storm, Irish wind power actually increased earlier than in the UK). Assume that we have similar conditions in 2030 and 50 gigawatts of wind turbines. For about 15-20 hours, UK wind power might be able to achieve useful export prices. But once continental production had ramped up as the storm moved eastwards, prices would crash.

Chart 1: 6 EU country wind production compared to UK in late March 2013

The point is made more clearly by a single comparison between Germany and the UK. Germany has plans to dramatically increase its offshore wind power by 2030, though some doubt it will ever make as much progress as it intends. But from the power coming from wind from midday on the 22nd to the end of the 25th March would have contended with the UK for the limited export markets for power.

Chart 2: German wind production compared to UK in late March 2013

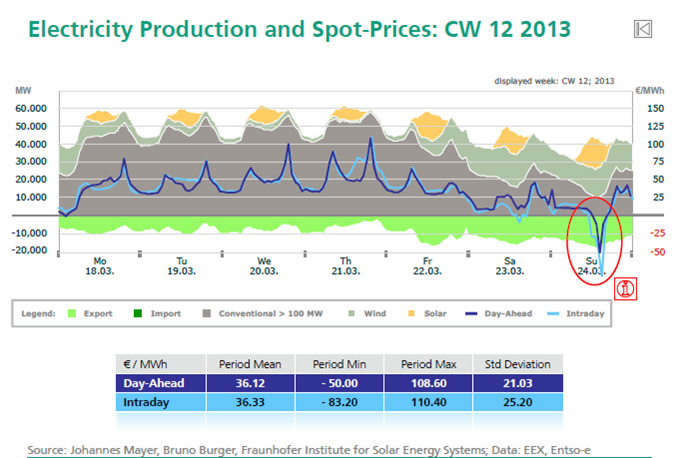

It’s worth looking at what was happening in German electricity markets over the course of the storm that helped UK wind turbines deliver so much electricity to the national grid. The following chart – produced by the team at the Fraunhofer Institute in Germany – shows how the price of electricity fell as the wind gathered force. As the speed rose over 21st and 22nd March, the market price of power in Germany fell to about €10 per MWh and subsequently to well below zero. (Compare this to the conventional UK wholesale price of about £50). On 24th March failures to estimate quite how much power would be delivered by wind and by PV, combined with an unusually large overestimate of how much electricity would be consumed meant that a large number of fossil fuel plants were contracted to produce power unnecessarily. On the 24th, the price of electricity fell to well below zero for several hours, reaching a nadir of less than minus €50.

During the entire period of the Atlantic storm passing over Germany from early on 22nd March to midnight of the 24th the price of electricity did not rise above €20 per megawatt hour, well below half the conventional price in the UK. The high winds over Germany, combined with larger than expected amounts of sun, disrupted the normal conditions in the electricity market. It wasn’t until a week later that an approximate normality returned to wholesale power prices.

In Chart 3 the blue lines represent wholesale electricity prices, falling to well below zero on Sunday 24th March. The green area below the line shows the net exports from Germany.

Chart 3: Fraunhofer data on German electricity prices and exports

Source: Source: Johannes Mayer, Bruno Burger, Fraunhofer Institute for Solar Energy Systems; Data: EEX, Entso-e

The crucial point is this. The high winds over Britain on the 22nd and 23rd March were manageable with today’s number of wind turbines. The UK had no equivalent surplus to Germany. But the expected seven fold expansion by 2030 would mean that the March 2013 storm would require the UK to be able to export power to the rest of Europe. Even this year this would have been impossible because the existing German wind and solar fleet were churning out excess power at the same time. The prices available for export from the UK would have been significantly negative, perhaps to the tune of hundreds of Euros per megawatt hour. This problem will get worse as Germany expands its wind farms, solar and farm waste digestion plants.

So we need to move on to the second point. UK energy policy currently ignores Germany, even though its existing renewable energy capacity dominates European energy markets for many days a year. Germany’s proposed transition (Energiewende) to a fully renewable future is widely regarded as impractical idealism by cynical Britons and therefore bound to fail. But, nevertheless, the move away from fossil fuel and towards low carbon sources continues in Germany, meaning that the number of hours per year during which which power prices are negative will continue to increase. A quick look at Chart 3 shows that in the week under study, Germany was exporting electricity for every single hour.

Why, one can legitimately ask, should UK consumers pay the price for huge investments in renewables when German over-investment in solar and wind is already creating surpluses for some of the year? Shouldn’t the UK just focus on building a system that takes German over-supply – at prices close to zero – and turns this electricity into methane (‘Power to Gas’) for use when power is in deficit? Otherwise Germany will run the European energy market as it today dominates the financial activities of Greece, Italy, Spain and Portugal. Traders on the German power exchange will influence power prices across Europe. The focus on variable renewables across Europe, and the low prices at times of high winds should force the UK to find way of taking the German surplus and storing for later use.

The welcome massive ramp-up of offshore wind in the UK will often produce large electricity surpluses. Assuming that export markets will accept these surpluses is a dangerous trap into which UK policy-makers are quickly leading us. We need to insulate the UK from German dominated price swings as European interconnection improves. This means storing UK electricity at times of surplus and building enough extra capacity to capture the cheap exports from Germany.

As readers of this blog will know, I think the only commercial way of storing electricity is by converting to natural gas.

[i] I used European Wind Energy Association (EWEA) figures for the installed power of UK wind. This figure is somewhat higher than the figure used by the UK market manager Elexon , which excludes wind farms not connected to the high voltage National Grid lines. EWEA includes some or all of the smaller wind farms that are connected to local distribution networks.