BP – electric cars are coming but won’t impact our business.

BP’s chief economist, Spencer Dale, gave a speech earlier this month about the impact of electric cars on the demand for oil.[1] He suggested that BP’s forecasts for EV sales to 2035 implied that the demand for petrol will be largely unaffected. Very roughly, today’s passenger cars use about 19 million barrels a day of oil. This will rise sharply, says BP, on the back of increasing world car sales. The number of EVs on the road by 2035 will only cut the need for oil by 0.7 million barrels daily, or less than 4% of current demand. The impact of electric cars will be dwarfed by the increasing numbers of petrol and diesel cars.

As usual with Mr Dale, the logic is clear and persuasively stated. But look beneath the surface of BP’s bullishness about the resilience of oil demand, and some of its strange assumptions about EV become clearer. The internal inconsistencies and omissions should make us concerned that BP simply isn’t facing up to a somewhat uncomfortable reality.

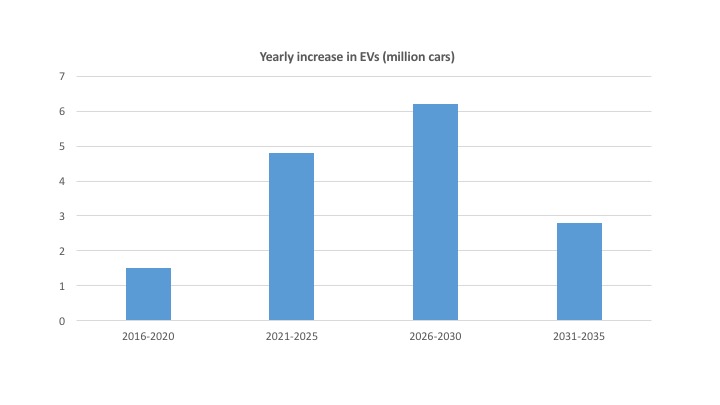

Two immediate examples from the article that follows below: BP forecasts EV sales volumes rising to 6.2 million a year between 2025 and 2030 but then falling to less than half this level - 2.8m per annum - between 2030 and 2035. This may be what BP hopes will happen, but what can possible be the logic behind this collapse in EV sales over a five year period? We are left in the dark as to why BP thinks this is a reasonable view.

Briefly, a second point. Spencer Dale’s speech omits any mention of China whatsoever.[2] But this year China is responsible for half the world’s sales of EVs as the government starts to try to deal with its awful air pollution. Any proper forecast would include at least a view on the car market that is now easily the world’s largest. Not a word in his speech.

BP's forecasts for electric car sales

Let’s dissect a little of what Spencer says in more detail.

1. BP says that the total number of EVs on the road today is about 1.2m. Actually, that number was reached at the end of last year. This year’s sales will be about 800,000, taking the total to around 2.0m (+- 0.1m).[3] As of today, therefore, Spencer underestimates the stock of global EVs by 40%. Frankly, this is not a good start for a forecast by a major international company.

2. Sales in 2016 around the world are running at about 50-55% above 2015 figures after about 40-45% growth in 2015. Nowhere in Mr Dale’s speech does he mention this, or any other numbers suggesting the strong buoyancy – to say the least – of current production growth.

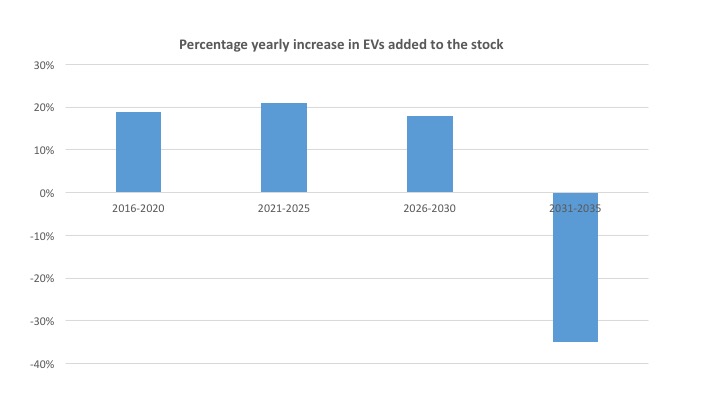

3. BP forecasts 7 million electric cars on the road by 2020. That’s consistent with a 19% annual growth in sales volume over the next four years, a substantial fall from recent rates. Nowhere is this discussed. An impartial observer might query why sales growth will diminish sharply just as manufacturers reduce EV costs to around petrol equivalents.[4]

4. It gets stranger. Between 2020 and 2025, sales growth speeds up again. It rises to 21% annually. And then it falls to 18% growth a year in the next five year period.

5. And then the market starts to shrink. Having been over 6m cars a year, it falls to less than half, or 2.8 m units. No explanation, no comment, no analysis. Mr Dale needs to go back to his forecasting team and ask why a maturing product, with purchase costs probably below the equivalent petrol car, should see sales more than halve over a five year period. To put this in context, electric car sales in the BP world will capture about 1.5% of car sales in 2030-35, up from around 1% today. Really? What is the logic here?

Source; BP

Source: BP

(There is a small inaccuracy here on my part. Most of the cars sold in the next few years will disappear from the fleet by 2035. So this figure slightly underestimates sale because it excludes replacements).

What doesn’t he say?

‘Economists don’t do cool’, says Spencer Dale as he admits that he cannot predict how consumer tastes will evolve over the next twenty years. This is a defensive statement, attempting to deflect some of the critical attention his speech will generate. I agree: economists are terrible at predicting how markets with a substantial cultural, technological or fashion element will evolve. (I partly know this because of my own early training in the dismal science). But this is no excuse for not at least mentioning some of the vital trends that are apparent even to us blinkered economists.

1. Spencer Dale’s speech makes no mention whatsoever of the legislative plans around the world to block the sale of new internal combustion engine cars. Some of these plans may well not come to fruition. But Norway (2025), the Netherlands (also 2025), Germany (2030) are three examples of countries that state that they will ban non-electric car sales. Immeasurably more importantly, India is also contemplating a sales block, possibly as early as 2030 or before.[5] China may make a similar decision, not least because its manufacturers are now clearly the lowest cost producers and a large domestic market will provide a springboard for export sales.

2. BP completely ignores the growing evidence of rapid EV development in light vans and buses. Spencer Dale says that only cars can be easily electrified at the moment. But, to give the most obvious example, La Poste in France and Deutsche Post in Germany are both making a transition to near-100% electric fleets for local deliveries. This is logical. Post vans have relatively short daily runs and usually return to a depot. The same argument holds for urban taxis and delivery vehicles. Buses are also moving to battery power as urban pollution becomes a central political issue. London is a good example as it moves to buy more electric buses. Purchase costs are sharply down and will cross diesel vehicle prices within a few years. Fuel costs are, of course, much lower and this is a more substantial element of bus running costs than a car.

3. Mr Dale does admit that urban pollution issues may cause increased sales of EVs. But he then ducks any estimate of what the impact might be, saying that he will stick with the narrow focus on carbon emissions. London? Delhi? Shanghai? Are these cities really not going to do as much as they can to reduce mortality-inducing particulate pollution?

4. EVs are particularly important because their battery capacity will be increasingly used to provide back-up power in a world of intermittent renewables. ‘Vehicle to grid’ charging – only just being rolled out by Nissan and others – is likely to become a crucial part of the grid stability armoury. A million 200 mile range cars (3% of the UK vehicle total) will provide about 7% of total daily demand in the UK if necessary. Of course we don’t know when this will happen, but there is strong economic logic to V2G and it deserves mention. Nothing at all from Mr Dale on the value of batteries.

5. Nothing also about the likely evolution of electric car costs and battery prices. No excuse here, Mr Dale. Even geeky economists like us can do forecasts of what is likely to happen to vehicle costs as learning curve effects drive down prices. In a 20 page speech there really ought to be something about how costs are going to change. How can an international company like BP make a forecast for electric car sales without at least a superficial attempt to estimate how prices are going to change in relation to petrol vehicles?

6. Spencer Dale admits that car sharing and autonomous vehicles may increase the speed of the transition to electric vehicles. But he ducks any estimate of the impact, essentially saying this is beyond his capacity. Instead, he uses the International Energy Agency high growth scenario for cars and posits this as the highest possible estimate for EV sales. Actually, those of us following the growth of renewables over the years know that the IEA is almost as slow as the oil companies in adjusting to the evolving reality. You only have to look at its consistent underestimate of the growth of solar PV to see this. (I cannot be sure but I also think there is an arithmetic mistake in how the impact on oil demand is calculated by BP).

7. Even more obviously, what about battery costs? When battery costs fall to $150 / kWh (probably less than three years away, I guess) the initial costs of buying an EV will be less than a petrol car for a 200 mile range machine. At the point, therefore, not only only the sticker price will be lower, but maintenance costs will be better, insurance costs will be cheaper and, of course, fuel will be less.[6] Why would any sensible person not buy an electric car by this point? Mr Dale seems to recognise that EVs will eventually dominate, but refuses to examine the forces that will drive an increasing speed to any transition.

If you work in an oil company, you will usually be surrounded by people saying that the low carbon revolution will indeed happen, but not quite yet. Your forecasts therefore show an eventual takeover off fossil fuel markets by electricity in a couple of generations. But the slope of the downwards curve for fossil demand is slight, putting far into the future any real need to address the need to adjust your own company’s portfolio of activities.

As Mark Carney and Michael Bloomberg have said today in London, this may convince investors and lenders today but at some near point in the future these illusions will be sharply stripped away. Mr Dale’s speech is a perfect example of how BP and others are avoiding facing up to the risks of rapid and destructive change in their business.

[1] http://www.bp.com/content/dam/bp/pdf/speeches/2016/back-to-the-future-electric-vehicles-and-oil-demand.pdf

[2] Except in one footnote like this.

[3] I believe that Jose Pontes, whose work is also widely published on cleantech websites such as CleanTechnica, is one of the best analysts of EV sales. http://www.ev-volumes.com/country/total-world-plug-in-vehicle-volumes/.

[4] VW is reported today as saying that its long range electric cars will be price competitive with diesel by 2020. https://chargedevs.com/newswire/volkswagen-says-it-will-offer-a-373-mile-ev-in-2020-at-the-price-of-a-diesel-golf/

[5] http://www.financialexpress.com/auto/news/govt-aims-to-make-india-a-100-electric-vehicle-nation-by-2030-heres-how/273629/

[6] In the spirit of curiosity, rather than a crude lusting after a desirable object, I visited the local BMW garage yesterday. I asked the EV salesperson about comparative costs. He gave me hard figures for annual servicing which were a fraction of petrol car servicing prices. And said that insurance costs are far lower because insurers recognise that EV drivers moderate their acceleration in order to maintain charge, thus reducing risks. He told me he had sold 120 cars this year, up from 60 EVs in 2015. He had only ever heard one complaint, and that was by a customer who bought a car with a defective battery in early 2015. Whatever the opposite is of a 'lemon', the BMW i3 appears to it. Mr Dale might also visit a BMW dealership to good effect. 6% of BMW's current US sales are electric.