A progressive carbon tax could be the low-cost way to decarbonise

The idea of a universal carbon tax is gaining popularity around the world. Instead of complex subsidies and regulations, we might be able to get decarbonisation more cheaply and simply if the use of fossil fuels was taxed at a rate proportional to the amount of CO2 emitted. As has been shown in the UK over the past couple of years, quite modest taxes on coal use have almost removed this fuel from the power generation mix. Carbon taxes raise the price of fossil fuels, disportionately penalising coal, the most polluting source of energy.

The voices in favour of a carbon tax now include Exxon, former US Secretaries of State and the Chinese government. The idea is appealing to the political right because it minimises the distortion to energy markets and, at least in theory, captures the full cost of carbon pollution, encouraging the quicker growth of renewables. Instead of expensively subsidising low carbon energy, with all the difficulties that this involves, perhaps it is better to simply make fossil fuels relatively more expensive? But those on the left have been less impressed because it will tend to increase the price of goods, such as natural gas for heating, that tend to absorb a much large fraction of the budget in lower income households.

Is there scope for compromise? Can we keep the right happy with a carbon tax and also appease the left’s concerns? Several countries are exploring – or have already introduced – a carbon tax whose proceeds are completely recycled to individuals and households. In the Canadian Province of Alberta, for example, fossil fuel use is penalised by a tax of C$20 per tonne of CO2 emitted. This has tended to increase the price of energy and items made locally using fossil fuels. But 100% of the tax raised is then paid out as an allowance to Albertans in the bottom half of the income distribution. This year a single adult will receive C$200 and a couple C$300. The net effect of the carbon tax and the rebate combined is to redistribute income from richer groups to the less well-off. This is because poorer people typically use less electricity and other fuels and buy fewer items with indirect or direct fossil fuel content.

How could this work in the UK? The country has CO2 emissions of about 390 million tonnes a year. (I’m excluding methane and other global warming gases in this illustration). About 65 million people live in the UK, so the average person is responsible for about 6 tonnes of CO2. If all fossil fuel use was taxed at, say, £50 a tonne the typical individual would see price rises of around £300 a year. (Calculating the CO2 embodied in imported goods would increase this figure).

Some of this would directly be via electricity and gas bills and increased petrol and diesel costs. Another portion would be less invisible because it would be wrapped into bills for other things. Restaurant meals, for example, might go up slightly because the costs of power had risen and ingredients had gone up slightly in price because of higher transport charges.

Let’s assume everybody in the UK was credited with £300 each year. As in Alberta, poorer folk would tend to benefit because they consume less energy, or things that embody energy, than the average. So their extra bills would not outweigh the £300 that they got annually from the government. In a sense, this £300 would be the beginnings of a ‘basic income’, the increasingly popular idea of a benefit that is paid to everybody, regardless of need or entitlement.

As an illustration of how a carbon tax merged with a rebate, or ‘basic income’, might operate, I looked at how much money UK households (not individuals) spend on electricity, gas and other domestic fuels, including petrol for the car. This analysis does not cover all the energy that is embedded in the goods and services we buy or are provided with using our taxation payments. But it does cover the direct expenditure on motor fuels and home energy. This is therefore a very simple and incomplete analysis but demonstrates how a carbon tax might help reduce income equality.

I used standard sources for this work.[1] The government produces an annual survey that splits homes into tenths (‘deciles’), ranging from those who have the least amount of money to spend to those who have the most. A household sitting at the top of lowest decile spends a total of about £194 a week, according to the latest data. A household in the top spends more than £1211 a week or over six times a much.

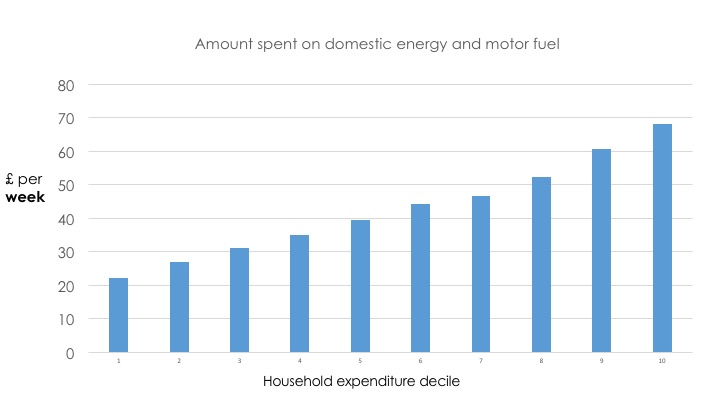

These totals are split into various categories. The survey records the average expenditure on fuel to heat the home and on petrol or diesel for a car. These weekly figures are in the table below. As you can see, households in the bottom decile spend more than £22 a week on home energy and fuel for a car. This is considerably more than 10% of total expenditure on all items. Domestic energy alone is about £17 a week, and this is likely to have risen as a result of recent price increases. People in the top decile spend eight times as much on motor fuels but less than twice as much on home energy. This means that overall they spend little more than half as much as the poorest tenth as a proportion of their income.

This is the core of the problem. If a country such as the UK puts a carbon tax on energy it will disproportionately affect the least well-off. It will be what is termed ‘regressive’. This makes a tax politically impossible. So I went on to look at the impact of recycling the whole tax back to UK households. (Of course, as in Alberta, it could be just given back to a less-well-off portion of the population).

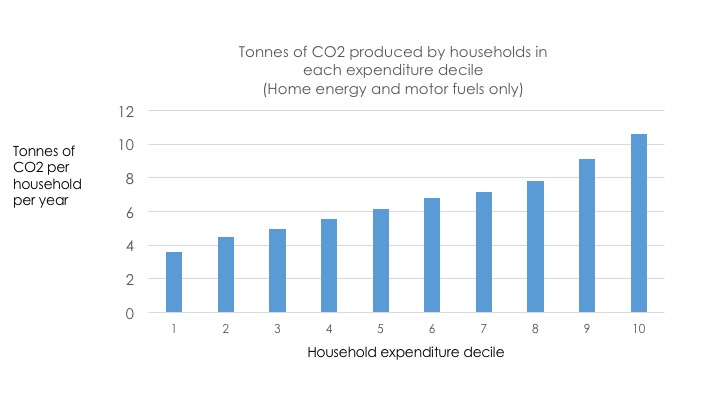

To do this exercise I had to make assumptions about the quantities of electricity, gas and motor fuels bought by each decile. And then I needed to calculate the amount of CO2 resulting from the use of these energy source. The analysis shows that a household in the bottom expenditure decile is responsible for less than 4 tonnes of CO2 (domestic energy and motor fuels only) while a home in the highest spending tenth accounts for over ten tonnes. The average is about 6.6 tonnes. (Note that these figures are for homes, which contain on average 2.4 individuals).

The next step is to calculate the extra cost that households in each decile would bear as a result of a £50 carbon tax. The lowest decile will see bills rise by just under £180 while the highest will pay an increase of about £530. (For the lowest spending households this would be a cost increase that took away about 2% of their total spending power and is thus very unlikely to be implemented without some form of monetary compensation.

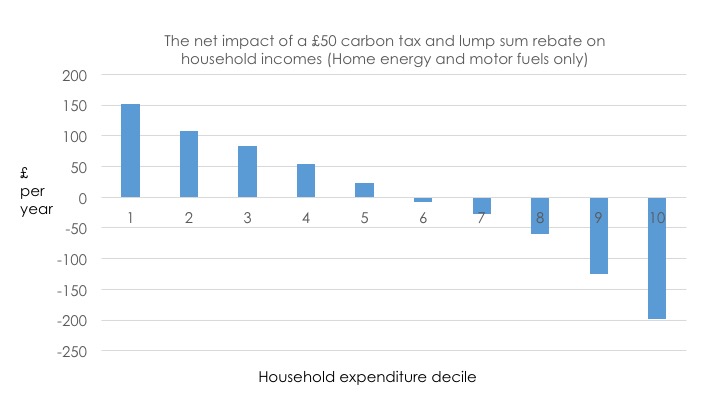

The final analysis is to assess what would happen if the entire tax were recycled as lump sum payment to each household. Each home would receive about £330, representing 6.6 tonnes times £50 per tonne. The net impact – tax cost versus lump sum rebate – is shown in the following chart. The numbers indicate that the least well-off homes would gain £150 a year and the wealthiest would lose £200. On average, payments would equal the tax.

When implemented in this naively simple way, a carbon tax can be made ‘progressive’ (helping the poorest and taxing the richest). The political right can approve, because the tax is an efficient and market-based way of taxing pollution while left can support it because the impact increases the net household income of poorer homes.

Of course a carbon tax should be made universal if it is implemented at all. It should cover all uses of fossil fuels including those employed to manufacture imported goods and services. Otherwise it will disadvantage home producers against foreign suppliers. The encouraging thing is that it looks more possible to get an international agreement on a standard carbon tax now than it ever has been in the past. (That's not to suggest it will be easy).

In the UK renewable subsidies are often blamed – usually inaccurately – for putting up energy prices by large amounts. It is becoming politically more challenging to get society to agree to continue to support low carbon energy (including electric transport). I sense it would be easier to get continued decarbonisation using a carbon tax, combined with a rebate, than continuing with subsidy schemes. And, perhaps foolishly, my training in economics gives me an almost religious faith in the price mechanism as a way of directing an economy.

[1] The Living Costs and Food Survey, ONS. https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/expenditure/bulletins/familyspendingintheuk/financialyearendingmarch2016