When will electric cars cause oil demand to start falling?

The volume of fuel needed to power cars and other light vehicles will start falling in early 2026. This is the prediction of a simple model I have built to forecast how the electrification of transport will curtail oil use. I think the model is the first systematic attempt to calculate the year-by-year impact of EVs.

By 2030, petrol and diesel use for light vehicles will be declining over 1% a year and the fall will accelerate rapidly thereafter. In that year, electrification will have pushed oil use 4 million barrels a day below what it otherwise would be. This equates to about 4% of today’s global production. But oil demand for fuelling cars and light vehicles will nevertheless be higher in 2030 than today because of the increasing overall volumes of cars sold.

I have built this model because the oil companies are now producing their own estimates of the impact of battery cars on oil use. These figures seem too informal and contain many unrealistic assumptions. I thought it might be helpful if I carried out a fuller piece of work. I want to stress that my spreadsheet is also uncomplicated but I think it represents a real advance on other ways of estimating this utterly crucial figure for the world economy, and our climate change ambitions.

The key input to the spreadsheet is, of course, the rate of growth of electric cars. In order to provide maximum credibility, I have used figures provided last month by Continental AG, (‘Conti’) one of the top five global car component manufacturers.[1] The company carried out a major review of the likely evolution of the car market, including conversations with other suppliers and customers.[2] Continental sees pure electric vehicles representing just under 20% of the global market by 2030. Hybrid electric cars will also have grown by that date, meaning that ‘close to 60% of the market will be electrified’ in the company’s words.[3] (This figure includes substantial volumes of what are called ‘mild’ hybrids, a type of vehicle that almost entirely relies on internal combustion engines). I think Conti's numbers are too conservative but I have used them because of the investment the company has made understanding its marketplace.

The start of the date at which oil demand for transport begins to fall is critical to the future of the oil industry. Large amounts of crude, particularly in high cost locations, will be stranded if EVs start cutting oil use soon. In common with other oil majors, BP has said that it expects oil demand for cars and light vehicles to continue to rising at least until 2035. Continental envisages both lower overall vehicle sales of all types in 2030 but also a much larger percentage of fully electrified battery-only vehicles than BP. Investors in both types of company – oil and automotive – should be interested in which of the future is correct. My model shows that if Continental is right, BP’s optimism is very mistaken.

Model outputs

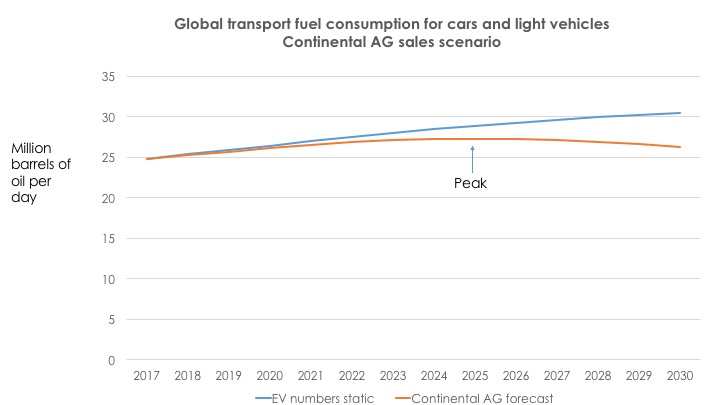

My model gives the following result for daily oil demand. The two lines below show a world of no further electric vehicle sales and one which follows Continental’s suggested trajectory. The gap between the two lines is just over 4 million barrels of oil a day in 2030. This compares with BP’s estimate of a gross saving of around 1.2 million barrels a day from electric cars in 2035 before taking increased vehicle numbers into account. (I do not know whether BP includes ‘mild’ hybrids in its calculations).

Source: Spreadsheet projections and Continental AG

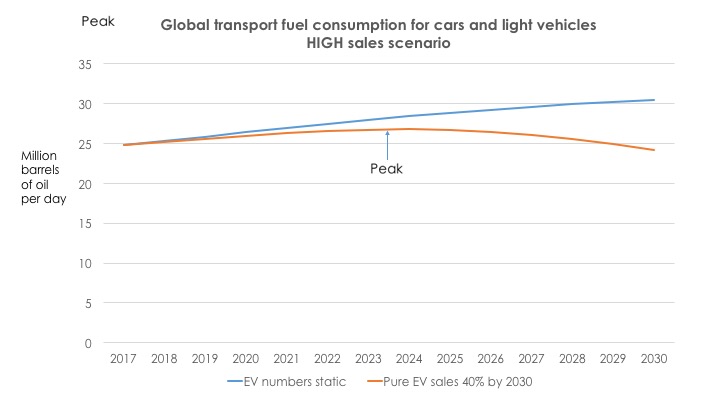

In addition, I thought it might be useful if I included another estimate that see pure electric cars grow at a faster rate. Continental sees 22 million new battery-only cars sold in 2030. What happens if this number is actually 40 million? (I also assume a faster rise across all years from today). This is a challenging figure, implying that about 35% of new cars and light vehicles are fully electric in 2030. However it is clearly possible, given that many of the manufacturers are now openly talking about 25% EV sales in 2025. My projection is below. As you might expect, the reduction in oil use starts earlier, falling from late 2024,and by 2030 demand is 6 million barrels a day below the ‘no electrification’ scenario. However, it is only by this date that oil demand finally falls below the 2016 level. The future challenge remains immense.

Source: Spreadsheet projections

Appendix

Method

The purpose of the model is to show how much petrol and diesel is used by cars and other light vehicles in each year to 2030. The fuel use is a function of the number of vehicles, the distance each travels and the average fuel economy (litres per 100 km travelled or miles per gallon, either US or UK).

The key inputs to the spreadsheet are

a) Historic and forecast car and light vehicle sales, both electric and conventional.

b) Estimates of the length of life of cars and other vehicles. How many vehicles made in each previous year are still being driven? (Evidence from the UK is that very few vehicles more than 25 years old are used on the roads. Those that are still in service will generally drive very small numbers of miles).

c) Estimates of how many miles/kilometres vehicles drive per year. If the UK is any guide, the distance travelled falls sharply as the car ages. The model assumes no change in future in average vehicle miles for each age of car.

d) Fuel economy estimates. The spreadsheet estimates how much fuel is consumed per kilometre travelled based on average fuel economy for each year. The fuel economy of a car made in a particular year is assumed not to change as the car ages.

e) Estimates of how much fuel is saved for each class of electrified car or other light vehicle. Continental splits its forecasts into different classes of electrification and the model suggests a fuel saving for each type.

A simple example. To build up an estimate of the number of barrels of oil needed to fuel cars and light vehicles in 2016 I needed to calculate the number of vehicles produced in 2003, for example, that were still on the road, the average mileage travelled and their fuel economy. I want to stress that all of these numbers are uncertain and therefore there will be errors in my inputs. However my estimate of the total amount of fuel used globally is consistent with estimates produced by the US Energy Information Administration.[4]

More detail follows on these inputs.

a) Vehicle sales. The yearly sales of all type of vehicle were about 94 million in 2016. This includes heavy freight vehicles totalling about 3 million. I have assumed that these will not be electrified in the near future. (Although Elon Musk as has recently talked about a planned articulated or ‘semi’ truck in recent weeks). So I use a 91 million estimate. I increase this number in line with Continental’s forecasts, reaching 111 million in 2030.

b) Age of cars on the road. The UK publishes statistics on the age distribution of its cars. This enabled me to work out the mortality rates of vehicles. If, for example, we see 1.5 million of the 2006 registrations were still around in 2015 but only 1.4 million in 2016, we can estimate the age distribution of vehicles leaving active use. We can show that, on average, 15% of vehicles are removed from the road in their fourteenth year, the peak year for mortality. Care is needed here; the average life of vehicles has increased substantially in the last twenty five years but this effect appears to have slowed down or stopped, at least in the UK. I use the pattern of UK car mortality as the basis of my estimate for the world.

c) In the UK, the use of car declines as it gets older. This seems to be largely an effect derived from heavy car users buying new vehicles and then selling them to lighter drivers as the car ages. There is also a minor impact from people driving less as they grow older. If I buy a car when I am aged 50 and keep it for 15 years I am likely to use it much less when I am 65. I use the UK’s figures for the miles/kilometres driven for each year of a car’s age.

d) Fuel economy estimates. We have good data on the average claimed fuel economy figures for the major economies for passenger cars. ‘Real world’ fuel consumption is known to be substantially higher. And, of course, the fuel use of heavier vehicles such as buses and delivery vans is greater than domestic cars. I have created an estimate of the average fuel use (litres per 100 kilometres) for the world. This is not as brave as it sounds. The fuel economy of a Ford Focus will be very much the same whether it is sold in Ecuador or Germany.

e) Fuel savings by type of car. Continental sees four classes of electrically assisted vehicle. At the top of the tree is the pure battery car. (We will also see pure electric vans, of course, and increasingly battery-only buses). This saves 100% of its liquid fuel consumption. Then comes the plug-in hybrid. I assume this reduces oil demand by 50% below the standard car of the same age. So-called ‘full’ hybrids, which cannot be plugged in but save some fuel because of regenerative braking, a need for a smaller engine and other features save 25%, I estimate. ‘Mild’ hybrids, which use a battery to store energy from braking and use it to improve acceleration, save 12%. The latter three figures are my own estimates based on reading motor industry statements. If others can suggest better figures, please do get in touch.

The work I have described so far involves a number of careful guesses. I don’t want to pretend my model is particularly accurate. However the key point is that when I work out the fuel consumed by each yearly cohort of cars and add it up to get an estimate of the number of barrels of oil needed each year to make gasoline/petrol and diesel, my figures are very similar to the US government estimates. In other words, I may have wrongly individually estimated the global car stock, the fuel economy and the miles travelled but the final result is reasonably accurate.

The major problems with my model

a) I have extrapolated the rate of mortality of cars and light vehicles from UK statistics on cars alone.

b) Similarly, I have estimated how the mileage of cars changes with the vehicle’s age from UK data. This information is also self-reported by respondents to questionnaires and may suffer as a result.

c) I have had to generate assumptions of how much fuel the various types of hybrid save. (I have not included ‘range extender’ cars, assuming that this category will fade as battery size increases).

d) I do not know how fast underlying fuel economy will improve from now on. My assumption is that this will be quite slow, apart from the improvements induced by electrification. I have used a rate that gradually decreases. The underlying reason is not technological. Rather, it is that as the electric car market grows the R&D effort in large OEMs and component manufacturers will swing away from internal combustion engines.

e) I have assumed that electric car buyers are broadly typical of all buyers. In other words, the cars they buy or would have bought (e.g. large versus small, petrol versus diesel) mirror the market as a whole. To be clear, if electric car purchasers are would actually have otherwise bought very small cars, the savings in total global fuel consumption would be less than if they were otherwise to buy a large car. My spreadsheet sees the electric car sales pattern as similar to internal combustion engine deliveries. The same assumption is made with respect to the distance travelled, and how this changes as the car gets older, and the age at which the car is scrapped.

f) I have not included any impact from the arrival of autonomous cars, nor car-sharing. By 2030 these factors may be reducing the number of new cars sold, although the total mileage driven may not change much.

[1] Page 14 of this presentation gives the key numbers: http://www.continental-corporation.com/www/download/portal_com_en/themes/ir/events/20170425_strategy_powertrain_uv.pdf

[2] Continental provided estimates for 2016, 2020, 2025 and 2030. I have interpolated between these figures for the intervening years.

[3] In Continental’s terminology, a car is ‘electrified’ if it can be plugged into the electricity supply but also if employs any form of hybridisation, including what is termed ‘mild’ electrification using a small battery to assist acceleration and recover energy from braking.

[4] Figures available at www.eia.gov/outlooks/ieo/transportation.cfm