The size of the hydrogen opportunity

Two recent reports from respected organisations have looked at the future of hydrogen. The Energy Transitions Commission (ETC) envisages the possibility of hydrogen providing up to 20% of total world energy need by 2050 through the manufacture of up to 800 million tonnes of the gas. The International Energy Agency (IEA) is somewhat more cautious, estimating a figure of about 13%.

In addition, a report I wrote in March for the Hong Kong financial institution CLSA suggested that hydrogen might provide at least a fifth of global energy, a figure similar to the ETC estimate.[1] In all three cases, the authors look forward to a future energy landscape dominated by renewable electricity and hydrogen. (However the IEA assumes that over a third of all hydrogen will still be made using natural gas in 2050).

In this note I briefly compare the projections of the three analyses. The purpose is to show that although many of the detailed conclusions about the growth of the hydrogen economy vary significantly, the main projections have strong similarities. As an aside, almost all other recent research shares the central themes. Hydrogen, which is still not taking seriously by many analysts, is going to become a central part of the drive to full decarbonisation.

Although there is no consensus about the required scale of the industry, energy analysts are converging on a projection of an eventual market size of between 500 and 1,000 million tonnes of hydrogen a year. The energy required to make this is greater than the world’s total electricity production today. Hydrogen changes everything.

The sectors which will drive the growth of hydrogen.

1, Shipping. These reports envisage ammonia, a derivative of hydrogen, becoming the main fuel for long-distance shipping. Ships, such as island ferries, that cover shorter distances will typically use batteries. The ETC sees ammonia for shipping as being the single most important use of hydrogen by 2050 using about 145 million tonnes, twice today’s global production for all purposes.

2, Steel manufacture will also be an important market. I project that this will be the largest use of hydrogen. Other industries that need high temperature heat, including cement manufacture, glass-making and some chemicals, will provide large opportunities for the gas.

3, Aviation will decarbonise using synthetic fuels, made from hydrogen combined with CO2 probably derived from direct air capture. Aircraft, according to these three reports, will not use hydrogen directly in any significant quantities.

4, Personal cars will not move to hydrogen as the predominant energy source. Batteries will dominate. But some long-distance commercial vehicles that do not return to the same point each night may move to hydrogen fuel cells. Surface transport will therefore not be a major user of hydrogen, although I say that railways may move to the use of fuel cells.

5, Although much low temperature space heating will move to electricity, and away from natural gas, there is a significant role for hydrogen in this market.

6, Lastly, but probably most importantly, hydrogen will perform a vital role balancing the electricity market. When power supplies are abundant, hydrogen will be made and then converted back to electricity in conventional combined cycle gas turbines when there is an energy shortage. All three reports see this as a large-scale use of hydrogen. The IEA sees this function as demanding almost 100 million tonnes, almost 20% of its total projection of the global need for the gas. My figure is similar.

Other conclusions shared between the reports.

7, Hydrogen will be transported across regions largely by pipeline. Repurposed natural gas pipelines will play an important role.

8, Storage will be concentrated in newly constructed salt caverns, where this is possible. Large parts of the world, including much of Africa and Asia may not have adequate capacity but Europe, the Middle East and North America are well supplied with geological salt.

9, Transport from energy-surplus areas, such as NW Australia and Chile, will use ammonia as the carrier for the hydrogen.

10, The cost of green hydrogen will be dominated by the price of renewable energy. At prices of $20 per megawatt hour or below, hydrogen made from electrolysis would already be competitive with the ‘grey’ product in higher cost natural gas markets.

11, The relatively low figure for hydrogen production from the IEA arise because the Agency assumes that a large amount of decarbonisation will take place through the use of biomass. This, for example, explains the limited use of hydrogen for aviation. Instead, aviation fuel will be made from biological materials. Many will question whether the emphasis on sustainable biomass is remotely plausible. The ETC and I assume that almost all energy use will employ electricity or hydrogen made from electricity.

The central numbers

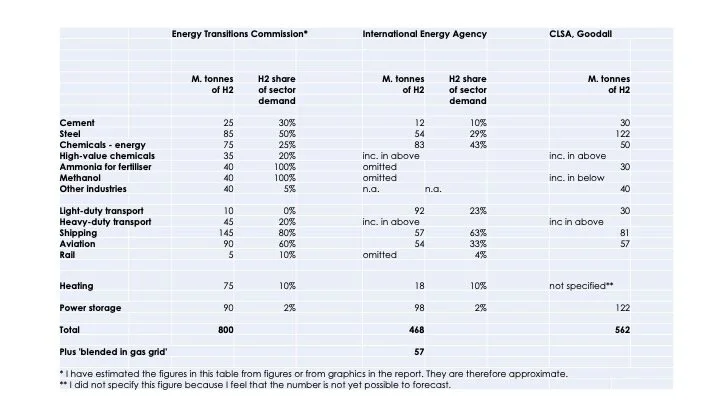

The table below gives some of the forecasts for hydrogen from the three reports. I should stress that some of these numbers may not be directly comparable because the authors use different definitions. In addition, the IEA report includes figures that vary between different sections of the document. This report also omits some critical estimates, such as the amount of hydrogen needed for methanol - an important precursor for many important chemicals - and fertiliser manufacturing.

How much 2050 H2 is from electrolysis?

ETC - About 680 million tonnes. (about 85% of total hydrogen production)

IEA - About 320 million tonnes (about 60% of total hydrogen production).

CLSA,Goodall - About 562 million tonnes (all prepared by electrolysis)

These differences are driven by the assumption about how much of the hydrogen is made from electrolysis of water and how much from steam reforming of natural gas with CCS.

Electrolysis capacity

ETC - 7800 gigawatts

IEA - 3600 gigawatts

CLSA, Goodall - 4800 gigawatts

These figures are approximately consistent with the forecast hydrogen production.

Share of final energy demand

ETC - 15-20%

IEA - 13%

CLSA, Goodall - 20%

The key differences derive from the assumption about how much remaining fossil fuel is used. A forecast with high gas use (with CCS) requires more primary energy production because of the inefficiencies of conversion into useful energy.

Eventual electricity generation 2050 excluding for the production of hydrogen

ETC - 93,000 TWh

IEA - 60,000 TWh

CLSA, Goodall - 120,000 TWh

I project that almost all energy-using activities are switched to hydrogen or electricity by 2050. The other forecasts are for a slower transition.

Cost of electrolysers, 2050

ETC - $100/ kW

IEA - $200-390/ kW

The figures by sector

The ETC report helpfully breaks down the use of hydrogen into industries. The IEA’s and my work partially replicates this approach, although I backed away from estimating the tonnage of hydrogen used to space heating and the IEA omits several important sectors from its analysis.

[1] Hard copies of the CLSA report are available. Please drop me a line at chris@carboncommentary.com if you would like me to send you a copy.