What is the focus of European climate tech?

The Net Zero Insights database and its associated tools track over 20,000 climate tech companies in Europe. Additional data is also available for the US. The information stored includes material on such matters as fundraising, products, technology and personnel.

This source gives us information on where new climate tech is most active and which sectors are developing the fastest.

Raising new external sources of finance

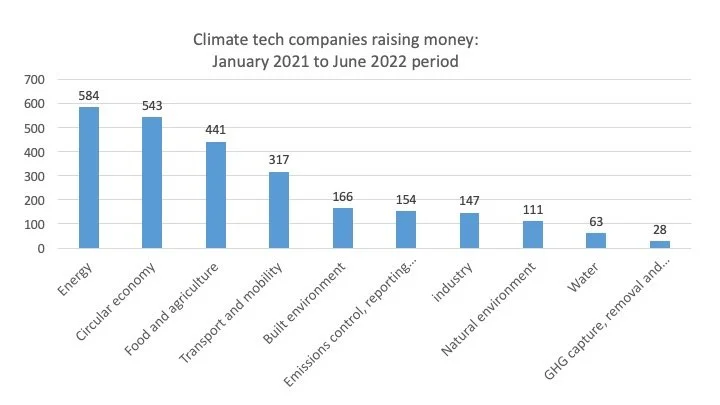

The businesses in the Net Zero Insights package can be divided into climate challenge areas. (A small number of the companies operate in more than one sector and are therefore recorded twice). The numbers below record how many companies in each area raised money in the eighteen months from January 2021.

Table 1

Source: Net Zero Insights

As we might expect, there are more new entities raising money in ‘energy’ than any other sector. But the number of companies taking in new cash in the field of the ‘circular economy’ is surprisingly close to the figure for ‘energy’ businesses. Next comes ‘food and agriculture’, with a big gap before ‘transport and mobility’.

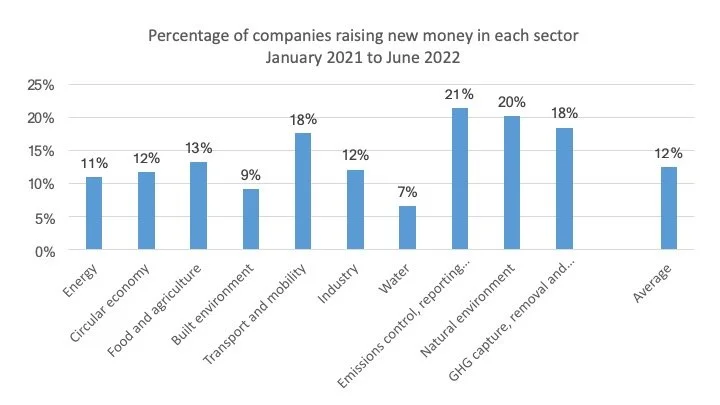

The percentage of businesses raising new money varies substantially between the sectors

Table 2

Source: Net Zero Insights

The percentages vary between the lowest (water) at 7% to the highest (Emissions control, reporting and offsetting) at 21%. The smaller sectors tend to have had greater numbers of new financings.

Areas of high interest

We looked particularly at four climate tech investment areas that need large numbers of new companies to take technology forward.

· Cement

· Steel

· Direct air capture

· Hydrogen

The database shows 621 entities in these four sectors, just under 3% of the total. Hydrogen is by far the most important, with 419 companies on the list. By contrast, Europe has only 20 ventures in direct air capture.

However the small direct air capture sector shows the most financing dynamism. Of the 20 companies, 12 raised money in the January 2021 to June 2022 period. In the hydrogen sector only 17% of the much larger number of business attained new sources of funding, though this figure is much larger than the 12% average across all sectors. Despite the importance of climate tech in steel, only a relatively small number of ventures - just 9 of the 94 businesses in the sector – raised new cash. 14 cement companies took in more money in the period.

The hydrogen sector raised almost €3bn in the eighteen month period under study. This is more than 4% of the new money invested into all climate tech ventures of around €67bn. Although a relatively small number of hydrogen businesses took in new money - 79 out of a European total of 2,544 fund raisings – the average amount invested was very large. The hydrogen investments (or fund raisings from sources such as government grants), averaged over €37 million per deal.

Green steel raised just over €0.5bn in the 18 month period and low carbon cement €260m. In the case of both industries, over half of this cash was taken in in the last quarter from April to June 2022. But despite the vital importance of decarbonisation of these two sectors, in aggregate they raised only just over one percent of the total money invested in climate tech in the period. This rate of financing needs to increase rapidly.