15 things to do to improve your climate impact

(This piece was commissioned by the Guardian to run during its 24 hour climate change blitz on 19th January 2017).

1, Air travel is usually the largest component of the carbon footprint of frequent flyers. After including the complicated effects on the high atmosphere, a single return flight from London to New York contributes almost a quarter of the average person’s annual emissions. Going by train or simply not taking as many flights is the easiest way of making a big difference.

2, Eating less meat, with particular emphasis on minimising meals containing beef and lamb, is the second most important change. Cow and sheep emit large quantities of methane, a powerful global warming gas, as well as contributing to climate change in several other ways. A fully vegan diet might make as much as a 20% difference to your overall carbon impact but simply cutting out beef will deliver a significant benefit on its own.

3, Home heating is next. Poorly insulated housing requires large quantities of energy to heat. Now that many people in colder countries have properly insulated their lofts and many have filled the cavity wall, the most important action you can take is to properly draft-proof the house, something you can do yourself. Those with solid brick or stone walls will also benefit from adding insulation, but the financial benefits are unlikely to cover the costs of doing the work.

4, Old gas and oil boilers can be massively wasteful. Even if your current boiler is working well it’s worth thinking about a replacement if it is more than fifteen years old. Your fuel use may fall by a third or more, repaying the cost in lower fuel bills.

5, The distance you drive matters. Reducing the mileage of the average new car from 15,000 to 10,000 miles a year will save over a tonne of CO2, about 15% of the average person’s footprint. Or, if car travel is vital, think about leasing an electric vehicle when your existing car comes to the end of its life. Taking into account the lower fuel costs, a battery car will save you money, particularly if you drive tens of thousands of miles a year. Even though the electricity to charge your car will be partly generated in a gas or coal power station, electric vehicles are so much more efficient that total CO2 emissions fall.

6, But also bear in mind that the manufacture of the car may produce more emissions than it ever produces in its lifetime. Rather than buying a new electric vehicle, it may be better to keep your old car on the road for a bit longer by maintaining it properly and using it sparingly. The same is true for many other desirable items; the energy needed to make a new computer or phone is many times the amount used to power it over its lifetime. Apple says 80% of the carbon footprint of a new laptop comes from manufacturing and distribution, not use in the home.

7, LEDs. Within the last couple of years, a new type of light bulb called an LED (light emitting diode) has become cheap and effective. If you have any energy-guzzling halogen lights in your house - and many people have them in kitchens and bathrooms today – it makes good financial and carbon sense to replace as many as possible with their LED equivalents. All the main DIY outlets now have excellent ranges. And they should last at least 10 years, meaning you avoid the hassle of buying new halogen bulbs every few months. Not will your CO2 footprint fall, but because LEDs are so efficient you will also help reduce the need for national grids to turn on the most expensive and polluting power stations at the times of peak demand on winter evenings.

8, Home appliances. Want to really make a difference to your electricity consumption? Frequent use of a tumble dryer will be adding to your bills to an extent that may surprise you. But when buying a new appliance, don’t always assume that you will benefit financially from buying the one with the lowest level of energy consumption. There’s often a surprising premium to really efficient fridges or washing machines.

9, Simply buying less stuff is a good route to lower emissions. A new woollen man’s suit may have a carbon impact equivalent to your home’s electricity use for a month. Even a single T-shirt may have caused emissions equal to two or three days’ typical power consumption. Buying fewer and better things has an important role to play.

10, The CO2 impact of goods and services is often strikingly different from what you’d expect. Mike Berners-Lee’s book ‘How Bad are Bananas’ takes an entertaining and well-informed look at what really matters. Bananas, for example, are fine because they are shipped by sea. But organic asparagus flown in from Peru is much more of a problem.

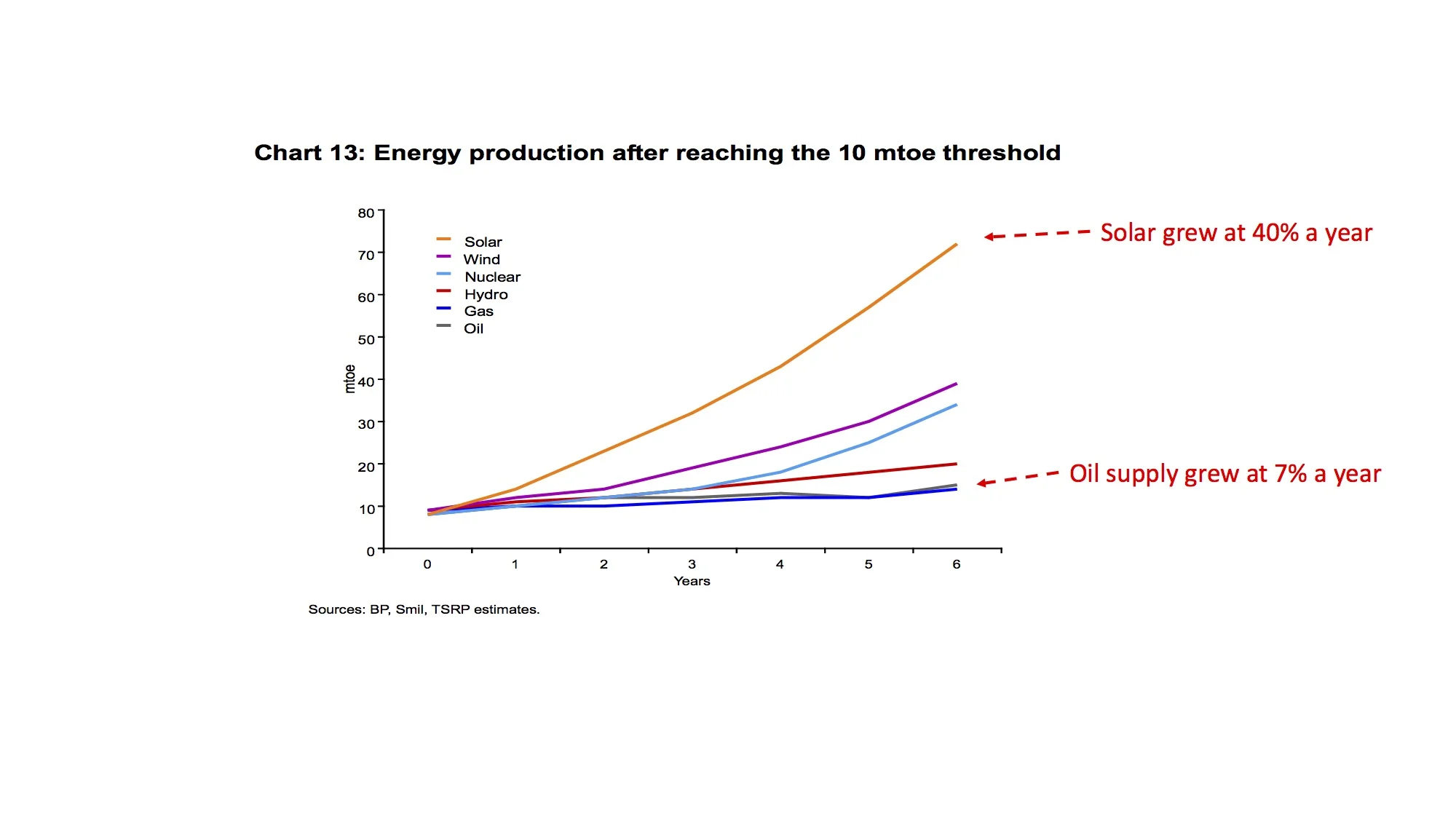

11, Invest in your own sources of renewable energy. Putting solar panels on the roof still usually makes financial sense, even after most countries have ceased to subsidise installation. Or buy shares in new cooperatively-owned wind, solar or hydro-electric plants that are looking for finance. The financial returns won’t be huge – perhaps 5% a year in the UK, for example - but the income is far better than leaving your money in a bank.

12, Buy from companies supporting the switch to a low-carbon future. An increasing number of businesses are committed to 100% renewable energy. Unilever, the global consumer goods business, says its operations will be better than carbon-neutral by 2030. One its main competitors, Procter and Gamble, has much less specific plans and at the time of writing its UK web site has taken down its policy statement on climate change. Those of us concerned about climate change should direct our purchases towards the businesses acting most aggressively to reduce their climate impact.

13, For a decade, investors ignored the movement that advocated the divestment of holdings in fossil fuel companies. The large fuel companies and electricity generation businesses were able to raise the many billions of new finance they needed. Now, by contrast, money managers are increasingly wary of backing the investment plans of oil companies and switching to renewable projects. And universities and activist investors around the world are selling their holdings in fossil fuels, making it more difficult for these companies to raise new money. Vocal support for those backing out of oil, gas and coal helps keep up the pressure.

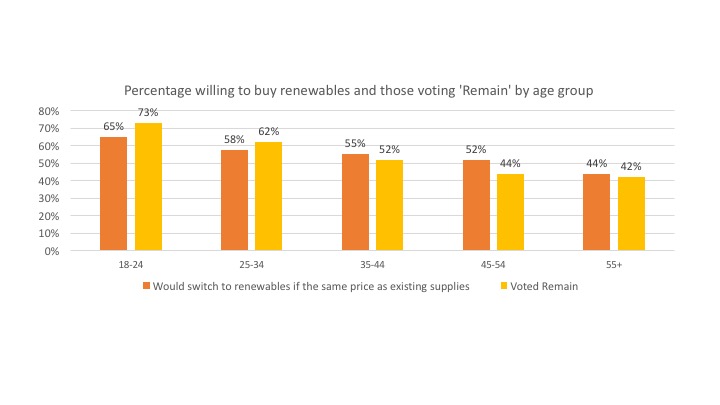

14, Politicians tend to do what their electorates want. The last major UK government survey showed that 82% of people supported the use of solar power, with only 4% opposed. A similar survey in the US showed an even larger percentage in favour. The levels of support for onshore wind aren’t much lower, either in the US or the UK. We need to actively communicate these high levels of approval to our representatives and point out that fossil fuel use is far less politically popular.

15, Buy gas and electricity from retailers who sell renewable power. This helps grow their businesses and improves their ability to provide cost-competitive fuels to us. Renewable natural gas is just coming on to the market in reasonable quantities in many countries and fossil-free electricity is widely available. Think about switching to a supplier that is working to provide 100% clean energy.