2017 BP Energy Outlook

BP’s Annual Energy Outlook forecasts how much energy the world will use until 2035. It breaks this down by fuel source and region. It also estimates the likely change in carbon emissions. The 2017 edition has just been published and I compared some key numbers to those published last year. My core conclusion is that BP is still reluctant to recognise how sharply falling costs will inevitably increase the growth rates of renewable electricity and electric cars.

Total energy demand.

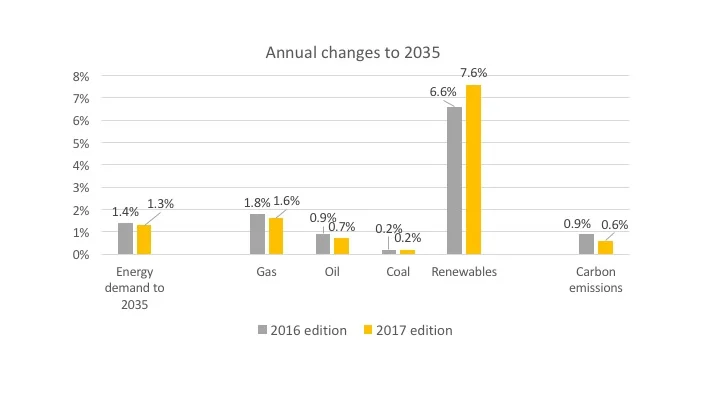

The chart below shows what BP expects to happen. World energy demand is now forecast to rise at 1.3% a year until 2035, down from 1.4% this time last year. Oil and gas growth rates are cut but, despite the impression in the text, coal demand is still expected to rise slightly.

The pattern of changes in renewables.

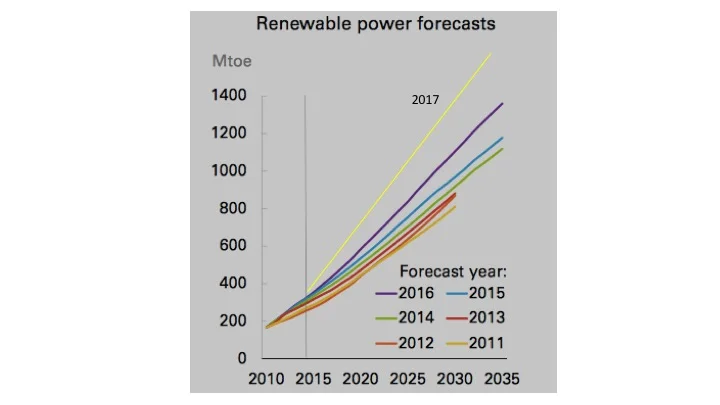

Every year since 2011, BP has increased its estimates for the total output of renewables in the next couple of decades. This year, the increase is as big as ever. In fact, the yearly revisions are tending to grow in size. We are still only looking at 10% of world primary energy demand by 2035, but at least this is trending in the right direction.

Source: BP Energy Outlook, 2016 and 2017

Why is BP getting more optimistic about renewables?

Last year, BP produced estimates of the cost of wind and solar that were massively out of line with analyst calculations of the cost of electricity produced. For example, BP said that solar PV costs in the US would average about $110 a megawatt hour in 2020.

All the estimates have come down in 2017. But they are still detached from reality. Reading off the chart, BP seems to be saying that PV in the US will cost, on average, about $58 a megawatt hour in 2035 - a cut of 30% on its 2016 estimates - although it might be as low at $35 in some locations. The finance house Lazard said the US is now at around $50-$55 for solar PV today in good locations. Rather surprisingly, BP sees no cut whatsoever in solar costs in the US between 2025 and 2035, a view that will be shared by almost nobody, either in the renewables industry or outside.

BP is also more bullish about onshore wind in the US and in China. In BP’s eyes, wind will be unambiguously the cheapest source of power in both places by the latter part of the next decade. By 2035, wind is shown as less than half the cost of either gas or coal in China.

This is where credulity is stretched very thin indeed. Even though BP shows renewables as by far the cheapest source of power in China, it assumes that they will represent only about 19% of power generation in 2035, up from about 7% today. There’s no explanation for this. Indeed, the only thing BP does say is that renewables integration into electricity grids will be relatively painless. So the reason for the slow growth is unclear, particularly in view of the Chinese government’s published expectations for renewables investments and its wish to retire much of its coal-fired capacity.

Electric cars

BP now acknowledges that electric cars exist, and will have some effect on oil demand. (In the past it said that natural gas would be a more important transport fuel than electricity). It projects 100m electric cars out of a total fleet of about 1.8 billion by 2035. EVs cut oil consumption by about 1% below the level it would otherwise have been. Electric cars only capture about 10% of the total growth in the number of cars on the world’s roads.

The company sees that battery costs are falling, and that eventually this will make EV’s directly cost-competitive – perhaps within ten years. But BP doesn’t say whether this on the basis of a purchase cost comparison or the easier target of being cheaper over the entire life of the car. Nor does it say why, if EVs are cost competitive, that only a tenth of incremental sales are electric over the next couple of decades.

It says that battery packs currently cost around $220 a kilowatt hour and sees this number falling to around $140 by 2035, while acknowledging the high degree of uncertainty about even the current numbers. Some will suggest that BP’s 2035 figures are already close to being achieved today. (GM was paying $145 a kilowatt hour for battery cells nearly eighteen months ago).

As with renewable electricity, I suspect we will see BP increasing its forecasts for EV sales as each new annual outlook appears. Nothing too dramatic each year but enough of an increase not to seem completely out of touch. But nothing in this year's Energy Outlook suggests that BP understands how the rapidly rising competitiveness of new energy sources will have self-reinforcing effects and increase the speed of the transition away from gas and, particularly, oil.