Is there an alternative to the Westinghouse AP1000 nuclear plant?

Toshiba is struggling to avoid bankruptcy because of the cost overruns at the two US sites constructing its subsidiary Westinghouse’s AP 1000 nuclear reactors. Latest estimates suggest that these new plants will absorb almost as much cash as Hinkley Point C per kilowatt of generating capacity.

The cost of electricity delivered by a nuclear power station is very largely determined by the amount of capital expended during its construction. This suggests that the AP1000 design will need a contract price for its power generation similar to the £92.50 plus inflation agreed for EdF’s Hinkley Point proposal. This number is now probably higher than the cost of offshore wind and substantially larger than the costs of solar or onshore turbines.

The Financial Times reports that the government wants to cut the rate paid to future nuclear stations by 20% or more. If neither the EPR design for Hinkley Point nor the AP1000 proposed for Moorside in Cumbria can achieve this, are other contenders available that might offer better cost control? The best example to look at is probably the four reactor project in the United Arab Emirates. Constructed by Kepco, South Korea’s dominant electricity supplier, this 5.6 gigawatt scheme is on track to start up the first reactor at some stage in 2017 and complete the final plant in 2020. So far, the evidence is that the design will probably cost about half the EPR and AP1000 per unit of generating capacity. My approximate calculations suggest that the Korean competitor can probably provide power to the UK at around £56 per megawatt hour, slightly lower than onshore wind today.

Nuclear construction prices have two key constituents. One is called the ‘overnight’ element. This is the notional cost of building the plant using the assumption that it is entirely constructed ‘overnight’. In reality, of course, nuclear power stations can take decades to complete. The money spent in the first year by the owner has an interest cost attached to it which will not be recouped until plant starts getting paid for generation. This is the full cost of construction.

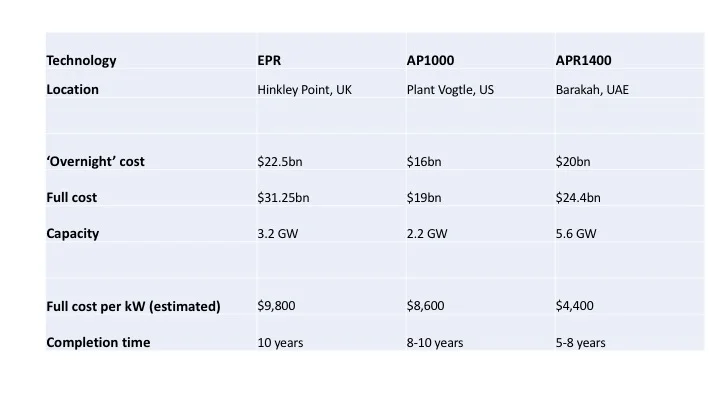

In the table below, I’ve written down what I think is the approximate overnight cost of each of the three reactor designs, at least as far as we can see today. In the second row, I have put the full cost, including the assumed interest cost. In both cases, I have had to use publicly available information. (This information is often confusing and I may have made errors).

Main points.

1) The Hinkley Point EPR is usually stated to have a projected ‘overnight’ cost of £18bn. I assume an exchange rate of £1 to $1.25. The full cost, including the interest burden during construction, is often written as £25bn, or about $31.25.

2) The two AP1000s being constructed at the Plant Vogtle site in Georgia, USA, are being constructed by Westinghouse and a subsidiary under a contract with four future owners, of which the most important is Georgia Power. Georgia Power is already charging its customers for the AP1000 construction costs and therefore the underlying ‘overnight’ and full costs are far from clear. Second, the contract sees most of the overrun being borne by Westinghouse and most sources seem to suggest that this number is currently about $3bn. However a quick look below at a photograph from January 2017 suggests that construction is still very incomplete and overruns may increase sharply both because underlying costs increase and because completion is delayed, thus increasing interest charges.

A January 2017 photograph of Plant Vogtle construction (copyright Georgia Power)

3) The detail available on the UAE Kepco contract is not great. It seems that the initial contract between Kepco and the state entity was for $20bn. I have taken this as the overnight cost. In late 2016, a re-financing was arranged for $24.4bn and I have assumed that this is the full cost including interest until the completion of the first reactor.

4) The table below shows that a) the Kepco APR1400 project is much bigger than the UK and US sites and b) it will be completed, as things stand today, much more rapidly than the AP1000 and the hoped-for 10 year cycle for the EPR at Hinkley. It also has a construction cost per kilowatt of about half the alternates.

An estimated assessment of the economics of construction and likely construction time

5) I’m going to employ a rule of thumb that the fuel cost of a nuclear power station is about $5 a megawatt hour and the operating expenses are around $14, including decommissioning. (Please note: although decommissioning costs are high, they are 60 years into the future. Therefore their ‘present value’, in the language of economists, is small. Anybody studying the costs of cleaning up the UK's early nuclear sites today is entitled to laugh at this idea).

My calculations suggest that if the interest cost required is about 9%, the Kepco APR1400 could be financed at a guaranteed UK electricity price of about $70, or approximately £56 per megawatt hour. This is just over half the inflation adjusted price being paid to the EPR’s owners at Hinkley Point.

Whether Hinkley Point is constructed or not depends on the ability of EdF to raise money in the capital markets. (It has just started a new fundraising that will help). But we know for certain it will be last EPR ever constructed since EdF has stated it will use a new design in future locations. By contrast, the international evidence is that the Korean approach to nuclear construction, focusing on ensuring that the design is standardised and experience gained at one location is transferred to the next site, appears to be working. Although the full details of the UAE project are not public, the project appears to be on time. The first of the four Berakah reactors will be probably completed within five years, an achievement that contrasts with the disastrous experiences with the EPRs in Finland and Normandy, France.

Should the UK invite Kepco to come in and develop a crash programme of nuclear construction? The design approval process will take 4 years, we are told. So the earliest the new capacity would be ready would be about 2028. By that time, offshore wind will probably be cheaper than the APR1000 costs and onshore wind and solar will certainly be. Whether energy storage has progressed fast enough for wind and solar to be sufficient is unclear.

The crucial point seems to me that if the UK wants nuclear – and people will have very different opinions on this - it needs to transfer its attention away from the increasingly complex business of getting Toshiba and its partners to construct Moorside and look instead to the world’s most successful nuclear power station constructors. Kepco stands out. I guess it could achieve the UK government's current objectives for electricity generation costs. So might the Russians and the Chinese, but their offerings are politically highly problematic, to put it mildly.