The struggles to make CCS work

The continuing difficulties facing the huge Gorgon carbon capture project in Western Australia must make us concerned about the viability of CCS elsewhere in the world.[1] As an informed Australian commentator said after recent announcements from the gas field, the Gorgon experience implies that CO2 storage will be more ‘expensive, slow and difficult’ than was hoped.[2] Each project will need to be carefully tailored to the precise geologic circumstances of the reinjection site. In his words, the difficulties at Gorgon show that CCS will be only a ‘vital and important, but niche, component’ of the energy transition.

Part of the offshore infrastructure for the Gorgon project. Source: Chevron

This would also be the conclusion of many of those associated with an earlier large CCS project to reinject carbon dioxide at the In Salah gas field in central Algeria. This experiment ran into similar geological problems and was abandoned after several years because of concerns that the CO2 might escape.

In both cases, the projects have been run by some of the world’s largest fossil fuel companies, all with huge experience in understanding geology and deep drilling. If these businesses cannot manage to achieve successful CO2 storage in nearly ideal conditions, there must be real doubts about whether carbon dioxide can be effectively stored in oil and gas formations.

Nevertheless, some governments around the world, and many fossil fuel companies, see CCS as a saviour technology that will allow continued large scale use of fossil fuels. The experience at Gorgon, and at almost all other CCS projects, suggests that this unthinking reliance on carbon capture is mistaken. The world will need to store CO2, but it cannot be a central plank of our decarbonisation strategies. Australia’s community-funded Climate Change Council summarises the history of global carbon storage in a unequivocal fashion - ‘no CCS project has yet been delivered on time, on budget or to agreed performance’. [3]

Gorgon CCS

Gorgon is a series of large offshore gas fields, operated by Chevron with shareholdings also held by Exxon Mobil and Shell as well minor stakes taken by Japanese gas supply companies. The project is one of the world’s largest sources of natural gas. Most of the production is liquefied to LNG and then transported to Asia.

The Gorgon gas field off Western Australia, with pipelines going onshore via Barrow Island, where the CO2 separation occurs. Source: Chevron

As with many other gas fields, the Gorgon output naturally contains some carbon dioxide. Percentages range from 1% up to about 15% depending on which of the several separate fields the gas comes from. Even small percentages of CO2 cause particular problems for the liquefaction process. CO2 freezes to a solid at higher temperature than those at which gaseous hydrocarbons turn to liquid. This causes damage to equipment at gas liquefaction plants, such as those that process the Gorgon output.

So the CO2 has to be separated from the natural gas. This is relatively simple. Some chemicals naturally absorb carbon dioxide and passing extracted natural gas over these chemicals will result in the CO2 being captured. The carbon dioxide can then be released again by simple heating, completely separating it from the hydrocarbons in natural gas.

In most places around the world where gas liquefaction takes place, the CO2 is released to the atmosphere. Gorgon was meant to be different. The CO2 was intended to be injected back into the sandstone formation from which the natural gas originally came. The developers promised to put back at least 80% of the CO2 that had been separated out. It hasn’t turned out as well as hoped.

An outline of how the Gorgon CCS scheme operates. Source: Chevron

The Gorgon project was started in 2009 and CO2 capture was intended to begin in 2016. The difficulties faced by the project meant that no carbon dioxide was actually injected until 2019. Since then, the sequestration process appears to never to have been fully operational and the amount stored is a fraction of what was expected. As a result, Chevron and its partners may have to pay fines of up to AUS$100m/$74m. (In the context of the project, this is an insignificant penalty).

What has gone wrong? The first problem was that when mixed with water CO2 forms carbonic acid, a weakly corrosive molecule. After the CO2 is injected into the sandstone formation, which is filled with water, the carbonic acid starts to dissolve the metal equipment in the injection well.

The injection of carbon dioxide into the sandstone increases the pressure in the formation. Unchecked, this would eventually result in underground rock fracturing and the possibility of the return of the CO2 to the surface. This eventuality has previously been vehemently denied by the CCS industry. In order to avoid leakage, Chevron created another set of wells to extract water from the formation to reduce the pressure. The wells did not work properly because both sand and water rose to the surface, eventually clogging the pipes. The difficulties resolving this eventually forced the Australian regulator to ask Chevron to reduce the rate at which CO2 was being injected into the formation so that the pressure did not rise too fast.

This problem seems to be persisting, reducing the rate at which the carbon dioxide is stored. Industry estimates suggest that only 2.5m tonnes a year are being sequestered rather than the 4m tonnes which was promised at the beginning of the project. Thus far, the CCS portion of the Gorgon project is said to have cost about AUS$3bn ($2.2bn) and has injected a total of about 5 million tonnes. If the current collection rates continue, the total amount sequestered is likely to be around 50 million tonnes during the lifetime of the field, about half of what was initially promised.

The CO2 capture and storage will be much more expensive than first forecast. Assuming the $2.2bn figure applies to the full 50 million tonnes collected, the capital alone will imply a cost of around $45 a tonne of CO2. The full price, including operating costs, will be much higher.

The experience at Gorgon mirrors the most signifcant earlier attempt by the oil and gas industry to sequester the CO2 originally mixed into natural gas.

The In Salah experience

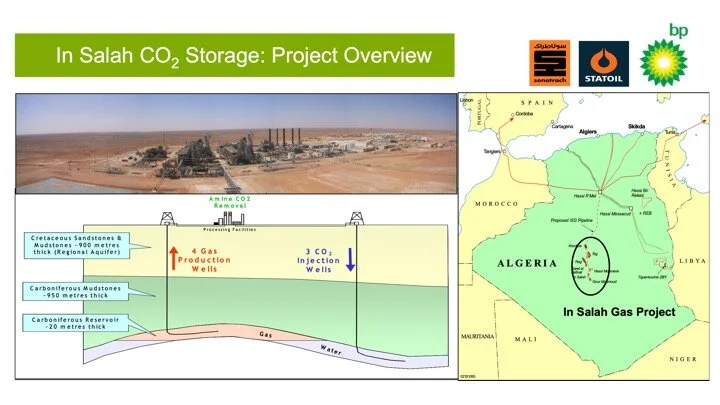

BP and Equinor (formerly Statoil) are shareholders in the In Salah field in central Algeria. The operator is state-owned Sonatrach, the largest African oil and gas company.

The In Salah field first began producing gas in 2004. It is expected to continue in operation until 2027. As in the Gorgon fields, the Algerian gas contains too much CO2 and the excess has to be removed. The target was to capture about 1 million tonnes a year and reinject it back in to the sandstone formation from which the gas has been extracted.

The In Salah gas field. Source: Sonatrach

The project was never fully successful. By 2011, when the CCS project was abandoned, about 4 million tonnes had actually been injected back into the gas-bearing sandstone formation.

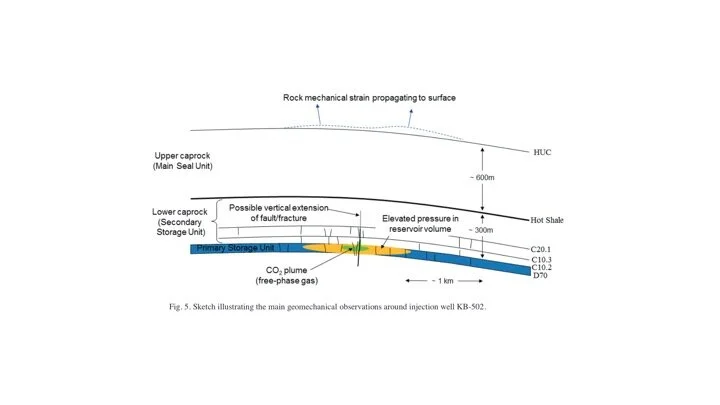

What went wrong? In this case, there appears to have been no attempt to reduce the pressure in the CO2 storage areas by extracting water. CO2 was injected directly into the sandstone formation and caused the pressure to rise to levels sufficiently high to fracture the rocks above, raising the possibility of a leak.

The following paragraph is taken from an academic paper written by engineers from BP, Equinor (then Statoil) and Sonatrach after the project was abandoned.[4]

‘Following the 2010 QRA (Quantified Risk Assessment), the decision was made to reduce CO2 injection pressures in June 2010. Subsequent analysis of the reservoir, seismic and geomechanical data led to the decision to suspend CO2 injection in June 2011. The future injection strategy is currently under review and the comprehensive site monitoring programme continues. Concerns about possible vertical leakage into the caprock led to an intensified R&D programme to understand the geomechanical response to CO2 injection at this site’.

The diagram below shows where the engineers suggest fracturing may have already occurred by the time the project was abandoned. (See, for example, the near vertical line in the centre of the graphic).

Visualisation of some of the problems at one of the CO2 injection wells at In Salah. Source: https://www.sciencedirect.com/science/article/pii/S1876610213007947

Although the risk of excess CO2 pressure producing or enhancing rock fractures was considered before the project began, it was not initially regarded as likely. The engineers had carefully selected the reservoir for injection, saying that it had ‘big storage capacity with a good insulation’ of rock over the top.[5] This turned out not to be the case.

BP engineers on the project had earlier described the storage geology at In Salah as ‘very similar to that of the North Sea’, where the company also hopes to develop large CCS projects.[6] We have long been told by specialists in CCS that injection of CO2 into depleted fossil fuel formations held no risks because the geology had already proved itself by retaining the gas or oil for hundreds of millions of years. The experience at In Salah and at Gorgon suggests that this does not provide sufficient security, perhaps because the volumes of CO2 stored result in pressures that are higher than projected by the geologists.

It is possibly a trivial finding but one other feature of In Salah needs mentioning, if only because the oil company engineers themselves discuss it in some detail. Parts of the land above the CO2 injection wells have risen very slightly (by up to 20mm) in response to the carbon dioxide stored at pressure over two kilometres below the ground. The direct significance of this is small, but it does indicate that large volumes of injection even into very deep formations can have unexpected effects on geology.

What does this mean for the future of CCS?

The world needs carbon capture and storage if it is to get to net zero. There may always be activities, such as the making of cement, that cannot be carried out without CO2 emissions and these must be safely stored. However the evidence from Gorgon and In Salah is that successful storage in oil and gas formations is almost certainly;

a) More difficult and expensive than expected.

b) Very dependent on geology. An approach to CCS that might work in one location might fail in another.

c) So rolling out CCS rapidly and at gigatonne scale in many hundreds of places around the world is not easy to envisage. We are still in the stage of CCS experimentation, and are well before a standardisable and inexpensive approach can be widely used.

d) Areas, such as the North Sea, which are touted as perfectly suited to geologic storage, may well be more difficult to use than currently expected by government and by the oil and gas industry.

e) Of particular concern is the development of a ‘blue hydrogen’ industry around NW Europe, which will probably rely entirely on finding CO2 storage sites in the North Sea. However, as our knowledge stands today, the injection of carbon dioxide is likely to be more costly and much more limited in tonnage stored than is being currently modelled.

[1] The two cases discussed in this note both involve injecting CO2 into the geologic formation that contains gas but at a location away from the gas field itself. We cannot conclude that all types of CCS, including injection into working oil fields, will experience similar problems. However very large scale storage (hundreds of millions of tonnes) does now look more difficult than we believed.

[2] https://www.abc.net.au/radionational/programs/sundayextra/chevron-gorgon-ccs/13467950 Interview with Peter Milne. Absolutely fascinating and highly recommended.

[3] https://www.climatecouncil.org.au/resources/what-is-carbon-capture-and-storage/

[4] https://reader.elsevier.com/reader/sd/pii/S1876610213007947?token=CA1B347BA1CD3EFB86A7F2B30B81BE638206DB66453686410CD6A56CC773892ED08E3CD4D2C7EC601DC59A5BE0C679A6&originRegion=eu-west-1&originCreation=20210730104253

[5] https://www.opec.org/opec_web/static_files_project/media/downloads/press_room/HaddadjiSonatrach_Algeria.pdf page 27

[6] https://ec.europa.eu/clima/sites/default/files/lowcarbon/ccs/docs/colloqueco2-2007_session2_3-wright_en.pdf page 10