How much of the UK's emissions are nearly impossible to decarbonise?

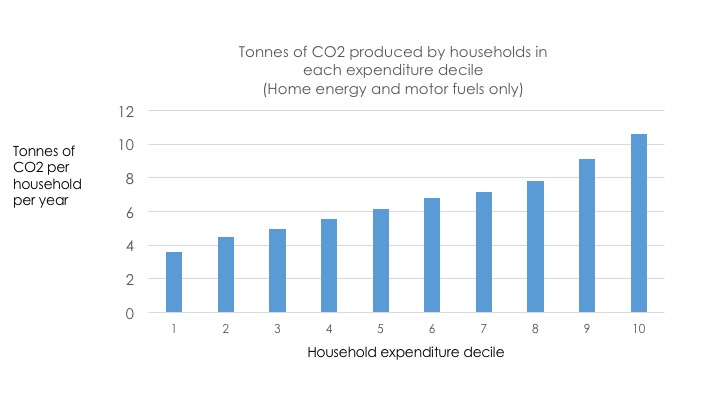

We can envisage decarbonisation of electricity production, of most transport requirements and much of our heating needs. But even after the obvious sectors have been shifted to zero carbon sources, the UK and other societies will still have very substantial emissions. I estimate in this article that CO2 emissions from energy use, which are currently running at about 367 million tonnes a year, are going to be very difficult to cut below 115 million tonnes, about 30% of today’s total.[1]

Why is this number - equivalent to 1.7 tonnes per person - so high? Critically, I assume that sectors which require fossil fuels because of their energy intensity are going to struggle to replace coal, oil and gas with electricity. You cannot melt iron ore easily, get a commercial airliner up to cruising height or avoid high temperature chemical processes without dense fuels such as oil or coal that burn at very high temperatures

However the world urgently needs complete decarbonisation. To make the obvious point, this means that net emissions in the UK must be zero as soon as possible

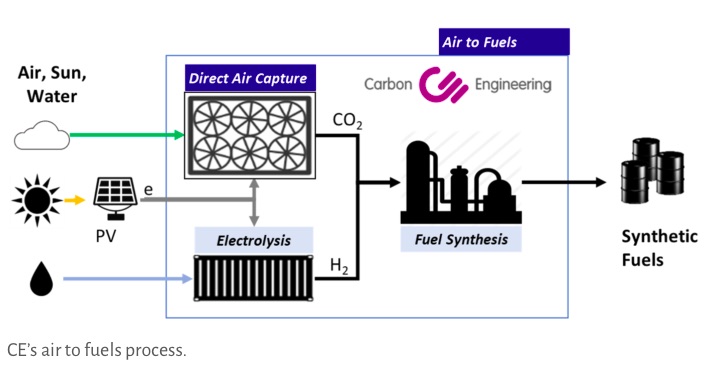

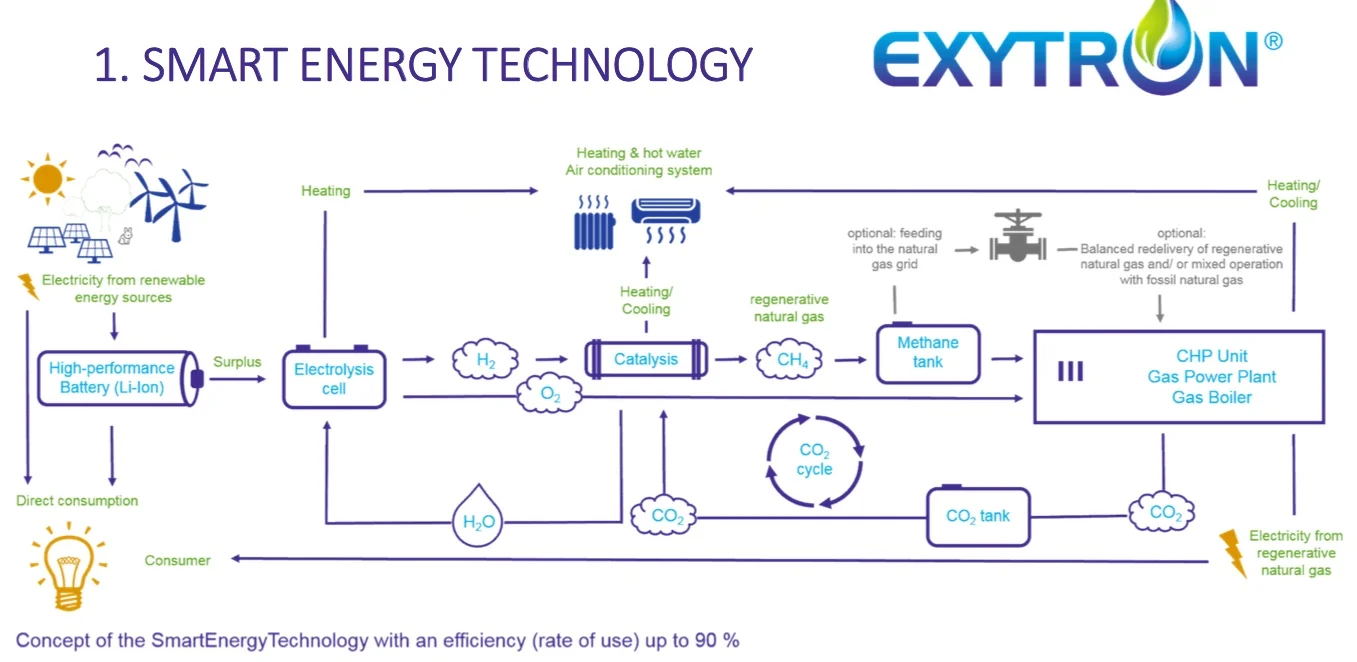

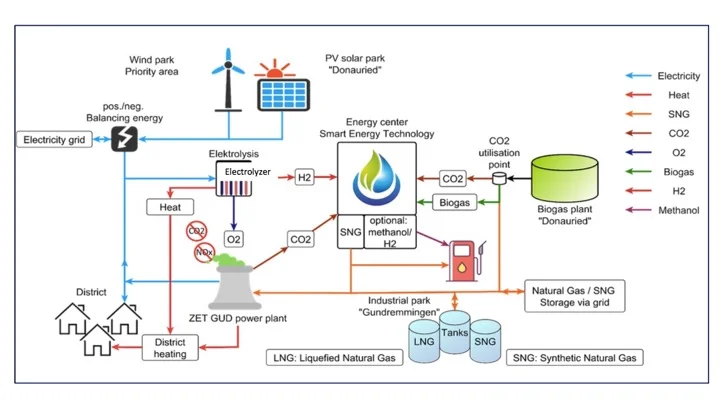

My argument in this article is that to achieve this vital target we will need to create synthetic replacements to fuel these very hard-to-switch activities. Principally, our aim must be the development of low cost hydrogen manufacture from water electrolysis. With large quantities of hydrogen made from renewable electricity we can create pathways for the production of fuels that do not add to CO2 or methane in the atmosphere. Somewhat inaccurately, we might think of oils and gases as merely the means by which the high energy of hydrogen atoms is carried in useful form.

The UK, and other societies, need to invest more in the production of fuels that replicate the characteristics of conventional fossil sources but without adding any net carbon dioxide to the atmosphere. As importantly, synthetic fuels will allow us to store energy from surplus wind and sun, allowing dull lulls to be accommodated. Without the storage of energy in synthetic fuels, covering electricity demand by using renewables will be both extremely difficult and expensive.

First, I offer an assessment of the size of the challenge we face in reducing our use of fossil carbon fuels to zero. I look at how energy demand is satisfied by the various energy sources and then calculate the impact of moving that demand from fossil fuels to electricity generated entirely from non-carbon sources. The first step is to ensure all electricity is from renewables, then to decarbonise transport by switching to electric vehicles as much as possible, then to move all coal and oil domestic heating to electricity, followed by gas domestic heating. I assess the climate impact of each shift.

Note: this analysis does not examine greenhouse emissions from activities unrelated to energy provision. These includes methane and nitrous oxide emissions from agriculture and raise total GHGs by about 80 million tonnes. This figure will also have to be reduced to a net zero.

1990 and 2017 emissions.

Emissions from UK energy use in 1990 were estimated at 583 million tonnes, or nearly 10 tonnes a head. Coal caused around of 222 million tonnes of this total. By 2017, coal use was down to little more than one tenth of previous levels and had been driven out of electricity almost entirely. But oil use has also fallen, now running at around three quarters of the 1990 figure. Gas use is up. Total emissions from energy use are now about 63% of the earlier figure. This is a good record by world standards, but emissions cuts are now stalling as the scope for reducing carbon use in electricity generation falters and the UK pulls back from solar and onshore wind.

The makeup of energy need today, expressed as primary energy flows

We probably all occasionally need reminding that electricity is a far less important source of energy than fossil fuels that are combusted for other purposes. The way the statistics are calculated for ‘primary’ energy puts electricity as just over 20% of the total terawatt hours.[2] (A terawatt hour is a billion kilowatt hours). Natural gas is over twice as large a source of energy and oil (petroleum) is also much more important than electric power. Why is this important? Because electricity is relatively easy to decarbonise, oil and gas combustion much less so.

Final energy consumption

Primary energy consumption measures the total inputs of fuel into energy production. But some fuels are employed as sources to be transformed into electricity or used for non-energy purposes, such as making plastics from oil. For example, 286 TWh of gas were used in 2017 to generate about 134 TWh of electric power. The final energy consumption figures in the chart below show that electricity supply - about 301 TWh in 2017 after excluding transmission losses – was less than 20% of total final energy need. Nuclear, conventional renewables and the burning of wood pellets were slightly more than half of the electricity supply.

Moving all electricity to zero carbon sources

Final electricity demand in the UK in 2017 was about 334 TWh. This includes transmission losses of 33 TWh, taking the delivered number down to 301 TWh as mentioned in the last paragraph. 156 TWh, including transmission losses, came from fossil fuels.

This 156 TWh of useful power took 358 TWh of oil, coal and gas to produce. Burning that 358 TWh produced about 76 million tonnes of CO2 out of the UK’s total emissions of 366 million tonnes, or just over 20% of the total.[1]

In other words, complete decarbonisation of the power sector would still leave the UK with almost 80% of its current greenhouse gas output from the use of energy.

Simply replacing fossil energy with renewables would be impossible. When electricity demand peaks, there is no guarantee of wind or solar being available. This is one of the reasons why I argue for an energy policy that includes the replacement of oil and gas by synthetic fuels. The UK can then hugely overinvest in wind and solar and, instead of curtailing production in times of excess power, it can divert the electricity to producing hydrogen from electrolysis so that an energy source is available at all times.

Converting all electricity to low carbon sources reduces emissions by around 76 million tonnes, taking the total down to around 290 million tonnes.

The electrification of transport

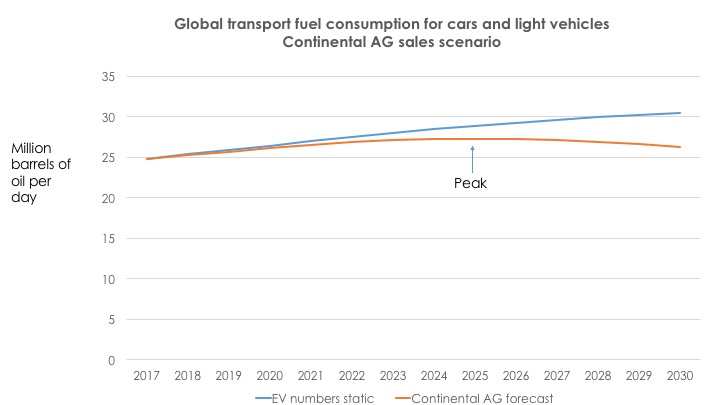

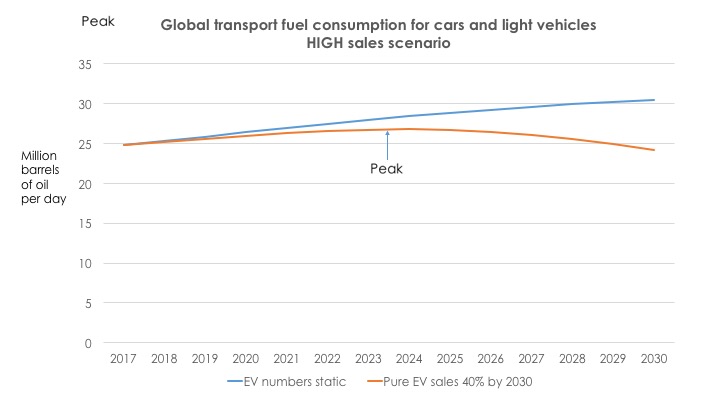

After a decade of scepticism, most manufacturers now assume that electric vehicles will replace both diesel and petrol cars. The issue is how fast this happens. In the case of heavier vans and trucks, the industry still plans for liquid fuel vehicles.

In my simple model, I assume that all petrol vehicles switch to electricity and 75% of diesel use also moves to battery power.

I believe that aviation will require liquid into the indefinite future. An aeroplane powered by a battery is just about conceivable for short flights with limited payloads. But unless the energy density (kilowatt hours per kilogramme of weight) of batteries improves by a factor of ten aviation kerosene will remain the fuel of choice for the vast bulk of air travel. A doubling or tripling of battery energy density looks possible but a ten fold improvement looks tough. Therefore I’ve kept oil-based fuels as the energy source for aviation.

In my calculations I have assumed that all transport is currently powered by fuels made from oil. This isn’t quite accurate because a small number of vehicles use electricity or natural gas. An even smaller group is powered by hydrogen. The simplification of saying that all cars and trucks use petrol or diesel doesn’t significantly affect the numbers.

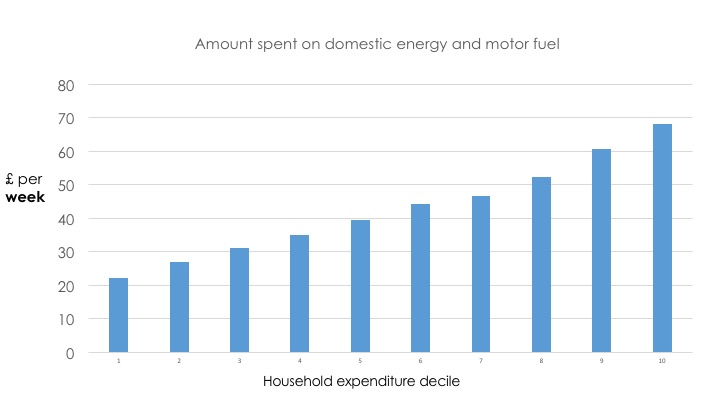

In 2017, transport used about 581 terawatt hours of energy. To give a sense of scale, that’s almost double the amount of electricity used in the UK. Just over half of this is diesel, which is consumed both by passenger cars and by heavy vehicles. However all internal combustion engines for surface vehicles are inefficient, only converting about a quarter of the energy in oils to motion of the car or lorry.

Conversion of all petrol use and 75% of gas oil and diesel to electricity, but leaving aviation to be powered by oil , reduces total liquid fuel needs to 206 TWh, or just over a third of the current level. This reduces emissions by a further 88 million tonnes, taking the total to around 204 million tonnes.

Avoiding the use of coal and oil for domestic heating

About 20% of the UK’s homes do not have access to natural gas. These houses are heated by electricity or by liquid petroleum gas (LPG), coal or oil. In this paragraph I calculate the effect of replacing all coal and oil use in the home with electricity. Oil is more important, supplying about 26 terawatt hours for domestic heating compared to about 4 for coal. Overall, the impact of switching these uses to electricity is quite small, removing about 6 million tonnes of emissions. This takes the remaining total UK energy emissions down to about 197 million tonnes.

Moving all domestic gas heating to electricity or other low carbon sources

Gas for home heating is a far more important source of emissions than oil or coal. In 2017, about 275 terawatt hours of gas heating were used (slightly less than the total demand for electricity). This produces about 52 million tonnes of CO2, so making all home heating zero-carbon would push the UK total down to about 145 million tonnes.

Of course moving all gas central heating to electricity or other low carbon alternatives, such as properly sustainable biomass fuels, is a truly enormous task. Gas demand today peaks in cold winter weather when the UK grid sometimes has to deliver over 300 gigawatts of energy to central heating systems. This is about six times peak electricity demand. So an electricity system that had to provide sufficient power in the winter to meet home heating demand (even if efficiencies were improved by the use of heat pumps) would have to be a large multiple of the size of today’s network. This is another argument for very large scale energy storage, probably in the form of synthetic low carbon replacements for natural gas.

Buildings other than domestic homes also use gas for heating. I have assumed that these uses will remain and will not switch to other sources. My argument is that converting these buildings to another form of heating is at least as difficult as switching domestic use. However a truly aggressive decarbonisation policy might be able to reduce gas use in these buildings.

Reductions in carbon emissions from reduced energy industry and losses in the energy system

Some natural gas is fed into oil refineries, for example to produce hydrogen. As oil demand falls, less is needed. Similarly, refineries themselves will cease to use as much crude or oil products if the demand for fuels falls.

Estimating the reduction in fossil fuel use from these changes is difficult. I have guessed that about 30 million tonnes of emissions are avoided.

What is left?

After decarbonising all these energy uses, we are left with a total need for about 626 terawatt hours. Coal provides about 37 TWh, gas 302 TWh and oil 287 TWh. This is over one third of the primary energy demand provided by these three fossil fuels in 2017. Massive decarbonisation still leaves the UK with substantial CO2 emissions.

The remaining CO2 emissions from energy use that is too difficult to decarbonise are about 115 million tonnes. In the world of maximum decarbonisation, gas and oil each produce about 50 million tonnes of emissions and coal just over 10 million tonnes. Thus there is a long way to go to completely avoid massive fossil fuel use even if we decarbonise all the parts of the economy that we conceivably can using current technologies.

The primary remaining energy needs are as follows

· Coal: fuel needed for iron and steel making and, to a lesser extent, other industrial processes

· Gas: industrial processes, heating for non-domestic buildings

· Oil: aviation, remaining diesel, industrial use.

Aviation alone is responsible for about 26 million tonnes of emissions, or about 0.4 tonnes per head. Next comes industrial gas use at around 20 million tonnes and a similar figure for gas heating for non-domestic buildings. Remaining diesel use is around 16 million tonnes.

What are the implications?

Even the most aggressive move to low carbon energy will not eliminate the need for extensive use of fossil fuels, particularly oil and gas. And the calculations in this note assume that we can move all home heating away from gas even though this will prove extraordinarily difficult. The remaining need for carbon-based fuels inevitably means that we will either need to change society dramatically, for example by banning air travel or spending many billions on home insulation, or we will be required to make low-carbon substitutes for fossil oil and gas. There really doesn’t seem to be any alternative.

Chemically, making synthetic low carbon fuels is simple. We can make a liquid with all the qualities of crude oil without much difficulty from low carbon sources.[2] In fact, these liquids are better because they do not contain ancillary pollutants such as sulphur. Creating a ‘renewable’ natural gas is even easier. We just need a cheap supply of low carbon energy, probably from wind or solar electricity.

The problem is that today these synthetic fuels are more expensive than their fossil equivalents, if made in the UK. As at August 2018, the wholesale cost of petrol and diesel is about 4p per kilowatt hour of energy (around 5 US cents). An open UK auction for large scale solar PV or onshore wind would probably produce a slightly higher number. Then converting renewable electricity chemically into synthetic oil necessarily involves costs and efficiency losses, implying that the cost of zero carbon substitutes will be higher than oil.

Today, using hydrogen sourced from electrolysis using UK wind or solar would probably mean that oil would cost about 7-8p per kilowatt hour (about 10 US cents), or possibly double what fossil oil costs today. We can usually replace coal with hydrogen, for example in steelmaking, but the cost today will be higher than the fossil alternative.

If we accept that some activities in the modern world will continue to need oil, coal and gas, then we have to find a way of making synthetic and low carbon alternatives no more expensive than today’s prices for fossil fuel. That means pushing down the costs of renewables, buying hydrogen in from countries where renewables are cheaper or letting the countries with the best wind or solar resources make our oil and gas for us. Not necessarily easy but there probably isn’t any alternative if we want the full decarbonisation we urgently need.

[1] I assume that each tonne of coal produces 2.5 tonnes of CO2, a tonne of oil 3.15 tonnes of CO2 and 184 kilogrammes are emitted per megawatt hour of gas burnt.

[2] This, for example, is what Carbon Engineering promises, using hydrogen manufacture from electrolysis combining this with carbon dioxide capture from the atmosphere.